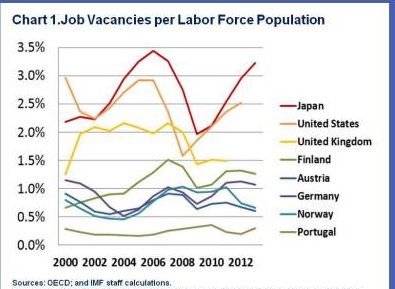

The chart from IMF reveals Europe's chronic problem, especially for the countries in Euro Zone. The chart shows job vacancies per labor force population. While the ratio remains high for Japan (+3%), US (+2.5%), for Euro zone countries it is just around 1% or below.

Euro zone really needs to improve its employment scenario by creating more jobs.

European Central Bank (ECB) is already pushing record easing by purchasing about €60 billion per month of asset purchase in a bid to boost inflation.

But the last thing Euro zone need is Asset price inflation thanks to easy monetary policies, what is required is demand driven inflation, which can hardly be achieved without maximum employment. Current ECB mandate doesn't include employment but it is expected to ease financial condition such that to boost growth and employment.

However, while loose monetary policy is keeping the conditions in place for employment and growth improvement, it clearly needs support of fiscal policy. Politicians in Europe, needs to go beyond poll friendly shorter term policies to growth and employment driven longer ones.

Unless Euro zone's tight labor market loosens Euro zone unlikely to realize its true potential.

With unemplyement hovering around 11%, it may not be wise to expect social stability.

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever