Violent conflicts have dramatically affected oil prices, especially when they occur in the Middle East. The potential for disruptions in supply, tend to send prices skyward. However, the rebound in the price of oil over the last few weeks can largely be explained by an improvement in demand and cuts in non-OPEC supply, rather than escalating Syrian crisis.

Lower oil prices over the last few months have stimulated more demand for fuel in many parts of the world, particularly in the United States and the Middle East, and oil production growth has also started to fall. Easing concerns about China and the outlook for US interest rates has also benefited commodities in general. This will help balance the market and will likely feed through to higher prices in the coming months.

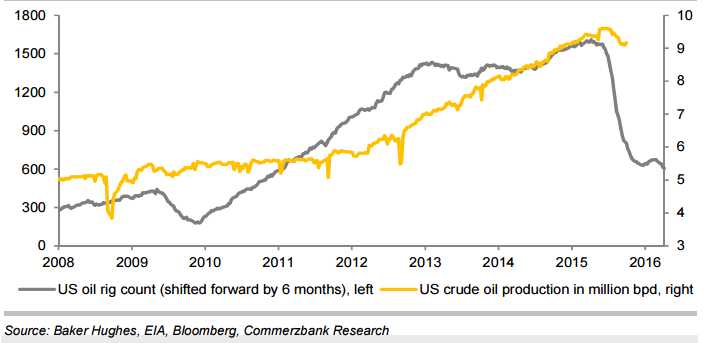

On the supply side, oil price has also been supported by production cuts. In particular, the number of active drilling rigs in the US has declined further and is now well below the trough seen in 2009. The rig count might start to pick up again in coming months as prices recover, but slower growth in non-OPEC supply should continue to support prices.

"We will continue to monitor the geopolitical risks closely, our price forecasts will still be driven primarily by the relatively predictable fundamentals of supply and demand. Brent is likely to hit $55 per barrel at end-2015, $60 at end-2016 and $65 at end-2017, compared to the current level of around $52", says Capital Economics in a research note.

Admittedly, the escalation of Russia's military involvement in Syria has provided a new dimension to uncertainty in the Middle East. However, the oil markets are probably right to have given relatively little weight to the latest twists in geopolitical risks. The events in Syria can be considered as a potential wildcard rather than a key driver of oil prices.

Indeed, it is not implausible that Russia's intervention could actually hasten a negotiated settlement to the Syrian civil war. Russia signaled it was willing to meet with other big oil producers to discuss the market following the decline in prices in the last quarter. A separate meeting between Russian and Saudi officials was being planned for the end of October, Russian Energy Minister Alexander Novak has said.

It is however to be noted that war has damaged much of Syria's infrastructure, including oil and natural gas pipelines and oil fields. Even if the international community could somehow beat back Islamic State militants and bring peace to the country, it would take many years for Syria's oil sector to get back on its feet. Simply put, Syria has ceased to be an oil producer, with no prospect of a rebound in the foreseeable future.

Oil prices recorded their biggest fall in six weeks on Monday after a report that OPEC continued to boost crude production triggered a wave of profit-taking from last week's 11-week high. Crude prices recovered some of the steep falls on Tuesday, with Brent futures up 1 percent in early European trade to $50.37 per barrel.

Events in Syria unlikely a key driver for oil prices

Tuesday, October 13, 2015 11:54 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K