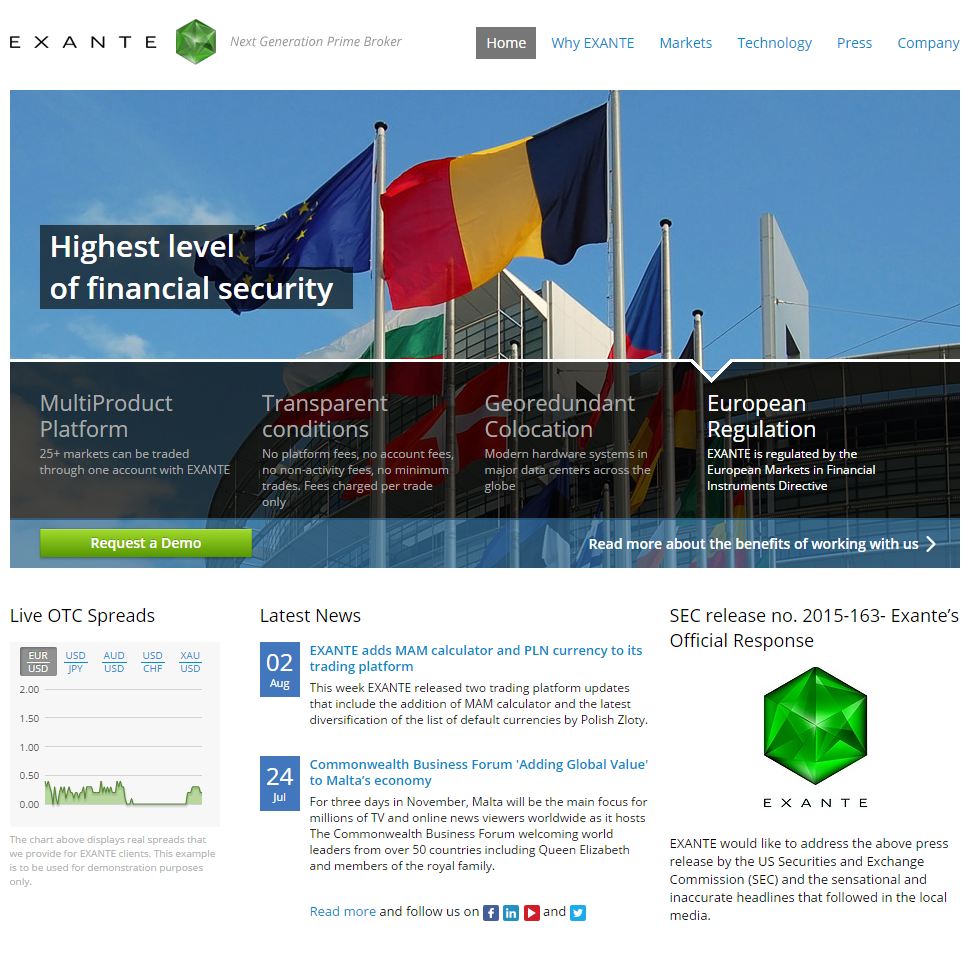

The Maltese prime broker, Exante, has refuted the US Securities and Exchange Commission (SEC's) allegation that it holds proprietary trading accounts at Interactive Brokers and at Lek Securities, which were used in connection with the scheme to make trades resulting in around $24.5 million in ill-gotten gains.

"Exante and Global Hedge frequently made illicit trades in the same securities, on the same days and around the same time, and often through the same IP addresses," the charges read.

Exante said that the charges levelled against it are a complete misrepresentation of its business model and the regulatory set-up it operates in. It has also denied that it acted as a hedge fund as was alleged in the complaint.

Exante responded, "The complaint completely misrepresents Exante, our business model, and the regulatory conditions we operate in. Exante has worked hard to build a strong brand respected by its peers that serves as a one-stop shop for all markets and instruments. The company was built for traders by traders and any illicit trading will not be tolerated."

"Contrary to claims in the complaint as well as in the media, Exante has never been and is not a hedge fund. Our business model is to execute trades for our clients."

The company added that it is in "direct contact with multiple authorities, including the MFSA, to resolve this issue swiftly. We have no doubt in time we will be proven to have acted in an appropriate manner and await the factual results.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary