Addicted to negative.

Bets in financial markets are slowly creeping up that FED will be following Bank of Japan (BOJ), European Central Bank (ECB), and Swiss National Bank (SNB) to follow into the territory of negative interest rates, at least on excess reserve. FED chair Janet Yellen came under tough scrutiny from lawmakers in her semiannual testimony before congress, over deposit rates, to be specific IOER (interest rates on excess reserve).

Lawmakers argued that FED is paying billions of Dollars to banks on their reserve. Last year FED paid $7 billion in interest to banks and the bill will go up this year, since FED hiked rates on IOER last December. Senators' argue, most of the excess reserve the banks hold with FED, which amounts to $2.4 trillion is due to proceeds from FED's quantitative purchase. FED's generosity is in sharp contrast to lawmakers' tough stance towards banks.

We feel, FED is unlikely to spur negative rates but if economy do keep weakening then FED might have no options to cut IOER at least to zero to spur lending.

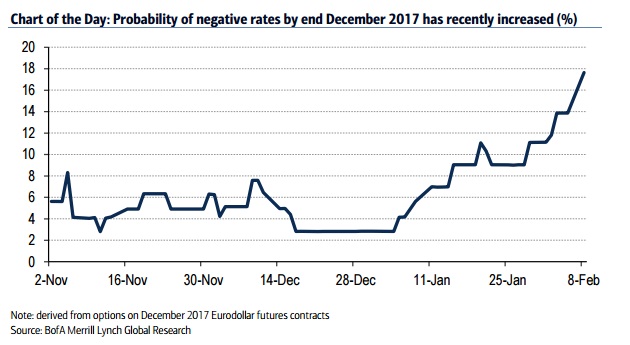

According to analysis by Bank of America Merrill Lynch (BofAML), Euro Dollar options market's probability prediction for negative rates from FED by end of 2017 has jumped from 3% in early January to above 17% as of yesterday.

However, Janet Yellen couldn't completely shrug off rate cut, she believes it is unlikely that FED would have to reverse course.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX