Chinese official including Central Bank president Mr. Zhou have so far shrugged off any concern over the problems of China, Debt, slowing economy and outflow.

In spite of so, evidence remains on the contrary and investors remain cautious over China.

Economic condition at a glance -

- Chinese officials have lowered their target of GDP growth to 7% from last year's 7.5%. Actual growth is 7.4% as of latest and below target.

- Industrial production further slowed to 6.8% compared to above 8% in last.

- Producer price index (PPI) continues to go down for 36 months at a row and decline accelerated to -4.8% as of latest data.

- Consumer price index (CPI) remains close to 1% much lower than central bank's target of 3.5%.

Outflow statistics -

- According to EPFR, a global fund flow statistic provider said last week China alone experience $ 1.35 billion outflow, highest among Asian countries. Despite the central bank's stance.

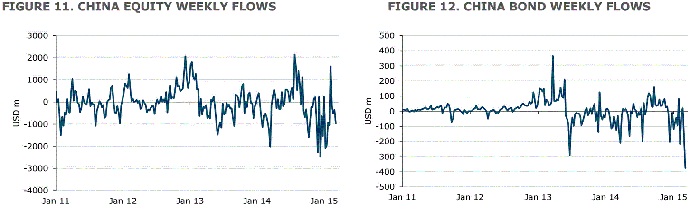

- Investors started getting their money out from latter part of 2014 and in January outflow regularly reached $ 2 billion weekly basis. Fund outflow continued after some inflow over central bank's rate reduction.

- In spite of central bank's policy easing stance, bond funds are experiencing outflows in tune of $200-400 million weekly as per latest data available.

- China's capital account registered net outflows in tune of $140 billion in last two months.

Chinese stock index CSI 300 might experience further gain as monetary policies will tend to be more dovish however they might face trouble along with Yuan should the outflow get aggravated. CSI 300 is currently trading at 3372, up 0.70% for the day.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?