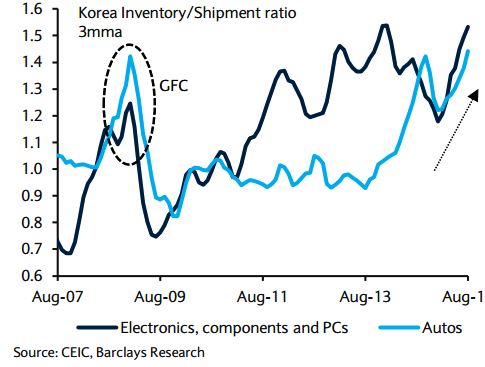

Korea's August IP and September exports both came in better than expected. However, the underlying trend remains soft. The improvement masks a concerning underlying trend, high excessive inventories.

The inventory/shipment ratio remains close to the 1.30x peak reached in December 2008 during the global financial crisis. The still-elevated inventory level will continue to weigh on production, and ultimately exports, especially for electronics, which may further have a bearing on Q3 GDP growth.

"As such, the BoK is expected to deliver another 25bp rate cut on 15 October, when it presents its revised outlook for the economy", says Barclays.

Further easing likely from BoK

Monday, October 5, 2015 6:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX