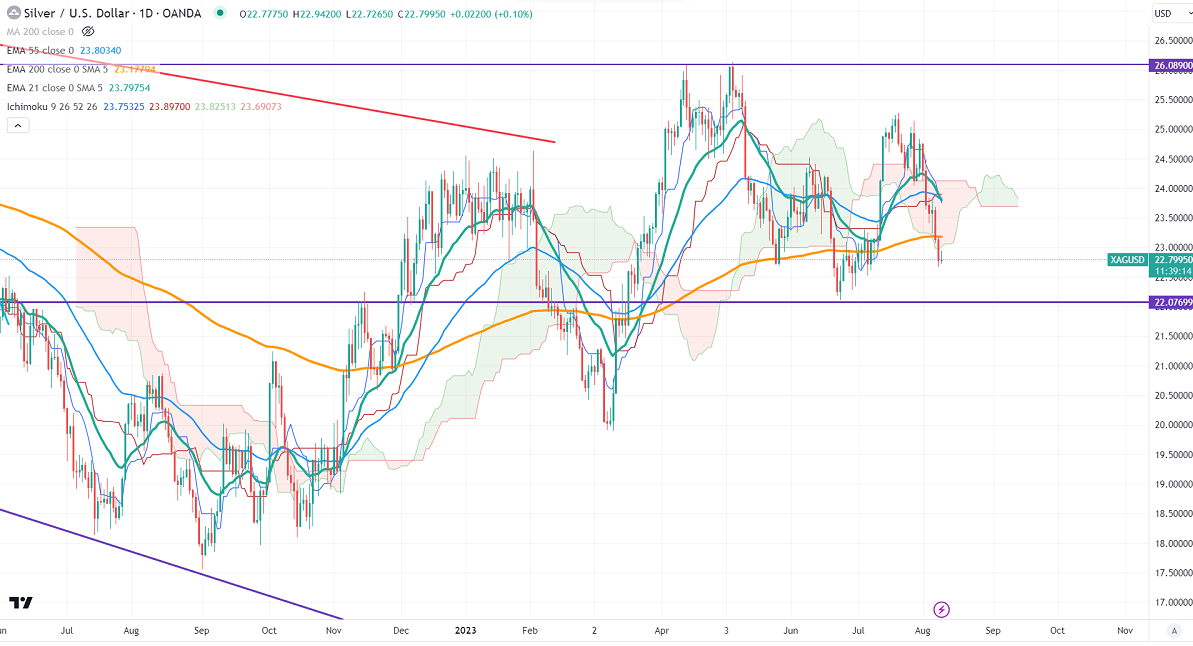

Ichimoku analysis (Daily chart)

Tenken-Sen- $23.906

Kijun-Sen- $23.897

Silver was one of the worst performers in the past three weeks and lost more than 10% on board-based US dollar buying. The US dollar index formed a temporary bottom at 99.58 on Jul 14th, 2023, and surged to 102.79 level. The surge of more than 25% in US treasury yields in the past three months also put pressure on precious metals. The short-term trend is still bearish as long as the resistance of $23.80 holds.

Technically, silver's significant support is around $22, the violation below will drag the pair down to $19.95/$19. The near-term resistance is at $23.20, any surge past targets is $23.90/$25.

It is good to sell on rallies around $23.15-20 with SL around $24 for TP of $20.10.