Silver-

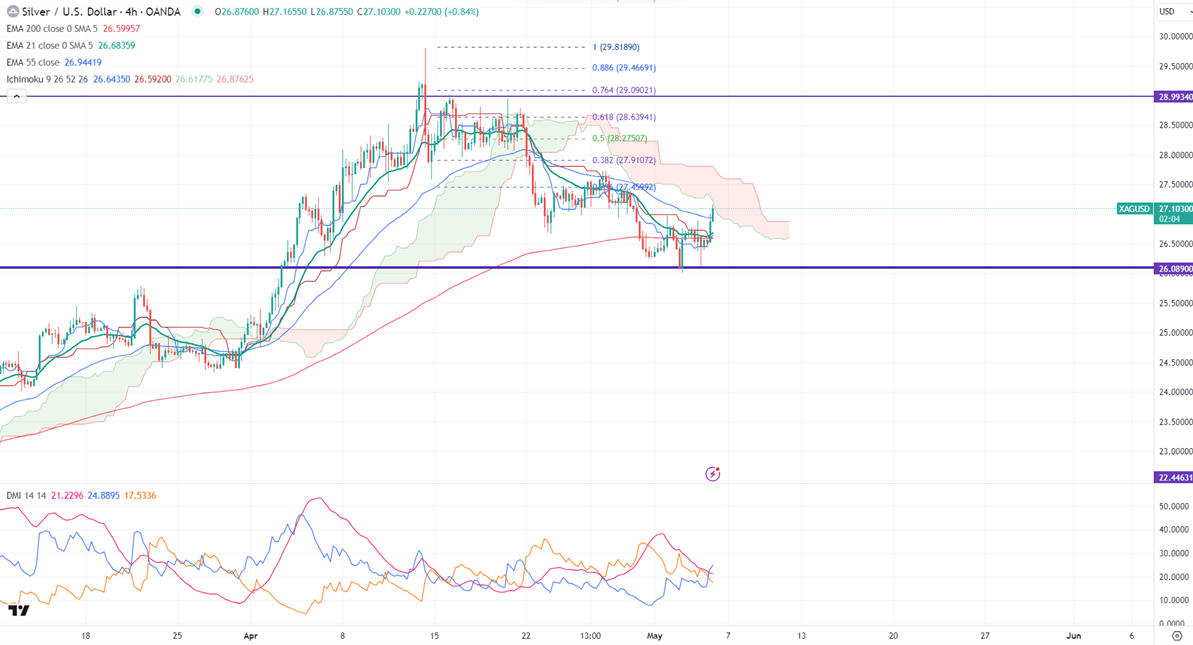

Ichimoku analysis (4-hour chart)

Tenken-Sen- $26.56

Kijun-Sen- $26.58

Silver showed a minor pullback after weak US jobs data. It hit a high of $27.16 yesterday and is currently trading around $27.105.

The US 10-year yield eased more than 5% this month due to a less hawkish rate pause.

According to the CME Fed watch tool, the probability of a no-rate cut in Sep rose to 49.9% in Sep from 44.20% a week ago.

Gold-silver ratio-

Gold/Silver ratio- 85.56. The ratio decreased from 87.84 to 85.56 in the past three days, well above the historical average of 52. So silver will outperform gold. It is good to buy silver at lower levels compared to gold.

Major trend reversal level -$30

It trades below 21, 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $26 and a break below the target of $25.54/$25. On the higher side, immediate resistance is around $27.20, and any breach above targets $27.75/$28/$29.45/$30.

It is good to sell on rallies around $ 27.18-20 with SL around $28 for TP of $25.