The US dollar, Swiss franc and Japanese yen have so far been trading with a reputation of safe-haven currencies. We could smell opportunities among these pairs in the risk-off environment by adding longs in CHF vs JPY in spot and options as well. While shorting SEKJPY and to hedge the beta of this trade to global and regional growth.

Long CHJFJPY has been one of the top strategic picks for 2020 premised on the substantial difference in the underlying balance of payments position between the two countries.

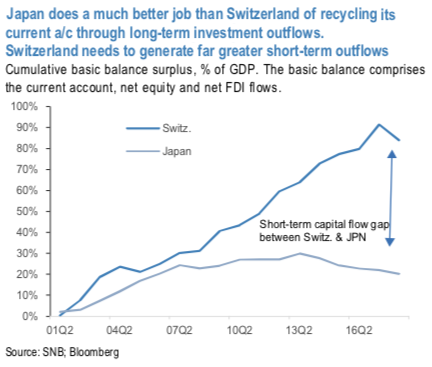

The bottom line is that Japan neutralises all of its current account surplus through outflows of long-term equity & FDI whereas Switzerland recycles only one-half in this manner (refer above chart).

In other words, Switzerland needs to generate substantially greater outflows of short-term capital than Japan. This not only biases CHF higher vs JPY on a trend basis, but also means that CHF could potentially hold its own versus JPY in risk-off environment. It’s fair to say that the thesis that Swiss franc (CHF) could prove more anti-cyclical than Japanese yen (JPY) has not yet been established (CHJFJPY has dipped a 1.5% in the last two weeks), so to be on the safe side we are buying JPY vs one of the most cyclical European currencies, SEK, to neutralise the possibility that we are could inadvertently find ourselves on the wrong side of a deeper shake-out in risk.

Hence, for now, we are still short CHFJPY spot and are short CHF-JPY correlation through a dual AED, the net spot position now converts to long CHFSEK. This off course is highly sensitive to growth and is well-placed to capitalise on a more substantive re- think of the regional and global economic outlook.

Sell SEKJPY at 11.268, stop at 11.493.

Long CHFJPY from 113.45 on Jan 14th. Marked at -0.83%.

Stay long a 2-month dual at-expiry digital (USDCHF < 0.9625 & USDJPY > 110.70). Bought at 10.5%. Marked at 2.52%. Courtesy: JPM

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields