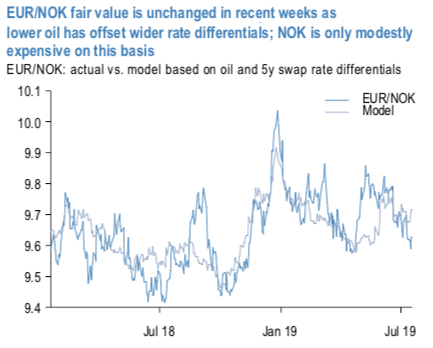

NOK’s lagging performance despite a wider rate differential is explained by crude prices. Assuming usual betas relative to oil, one could argue that EURNOK should have remained range-bound, yet the cross has drifted lower (refer 1st chart). NOK is expensive on this framework, but the magnitude is modest. On longer-term REER-based metrics, NOK is closer to fair value (refer 2nd chart).

SEK remains the cheaper currency among the two on standard frameworks, but valuations alone do not warrant longs in our view. We refer to JPM’s REER model, wherein SEK is the third currency globally and the cheapest in G10 (refer 2nd chart). SEK also continues to appear cheap adjusted for rate spreads, a relationship that has been dislocated for nearly a year now. Nonetheless, we don’t think this warrants long SEK exposure as the Riksbank is likely to be vulnerable to a dovish capitulation as the ECB becomes more dovish, and also since SEK is still among the lowest yielders globally. With the next rate RB hike at least 6 months away, there is little urgency to scale into SEK longs.

Active trade recommendations include long NOK exposure. NOK remains our preferred Scandi FX given a resolute central bank and higher yield and we retain residual exposure to this view in the trade recommendations (via a short in a 1.08 NOKSEK put with 1m left to expiry).

We also re-initiated EURNOK shorts intra-month motivated by a desire to a) increase the magnitude of EUR shorts in our portfolio on of the July 25th ECB meeting, where the balance of risks are skewed towards a more dovish direction in our view, and b) partially reduce the short high beta FX exposure in our portfolio. The risk to a tactically short EURNOK view is its sensitivity to a deterioration in risk sentiment, which is still possible given the soft global growth backdrop.

Medium-term views on both currencies are modestly bullish on gradual rate hikes, which puts them in contrast with other G10 central banks. EURSEK 1- year ahead target is unchanged at 10.45 so a 1% spot strengthening vs. the euro. EURNOK forecast 1-year ahead of the target is also unchanged at 9.60, also a 1% strengthening in spot terms (2.5% in total return terms). Risk bias for both currencies is kept unchanged at bearish given the downside tail risks to global growth and both are high beta currencies. Courtesy: JPM

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays