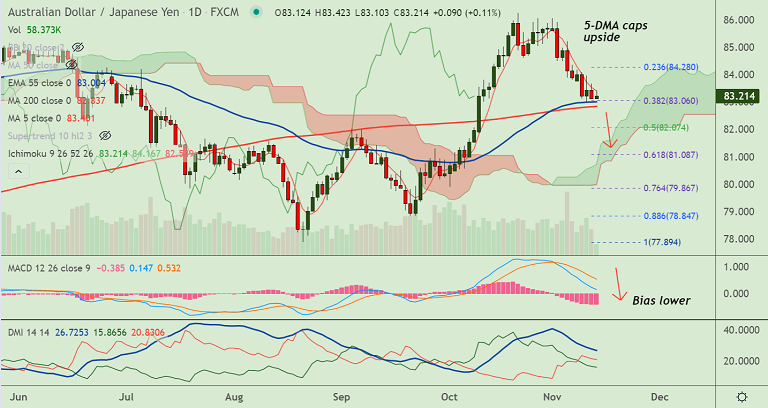

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- AUD/JPY was trading 0.12% higher on the day at 83.21 at around 10:30 GMT

- The pair has slipped lower from session highs at 83.42, upside capped at 5-DMA

- Momentum is bearish, Stochs and RSI are biased lower, RSI is below 50

- Volatility is high and rising as evidenced by widening Bollinger bands

- MACD and ADX support downside, GMMA indicator shows near-term moving averages bearish

Support levels - 83.00 (55-EMA), 82.83 (200-DMA)

Resistance levels - 83.40 (5-DMA), 83.91 (21-EMA)

Summary: AUD/JPY is trading with a bearish bias, recovery attempts lack traction. Scope for test of 200-DMA. Breach below will open downside.