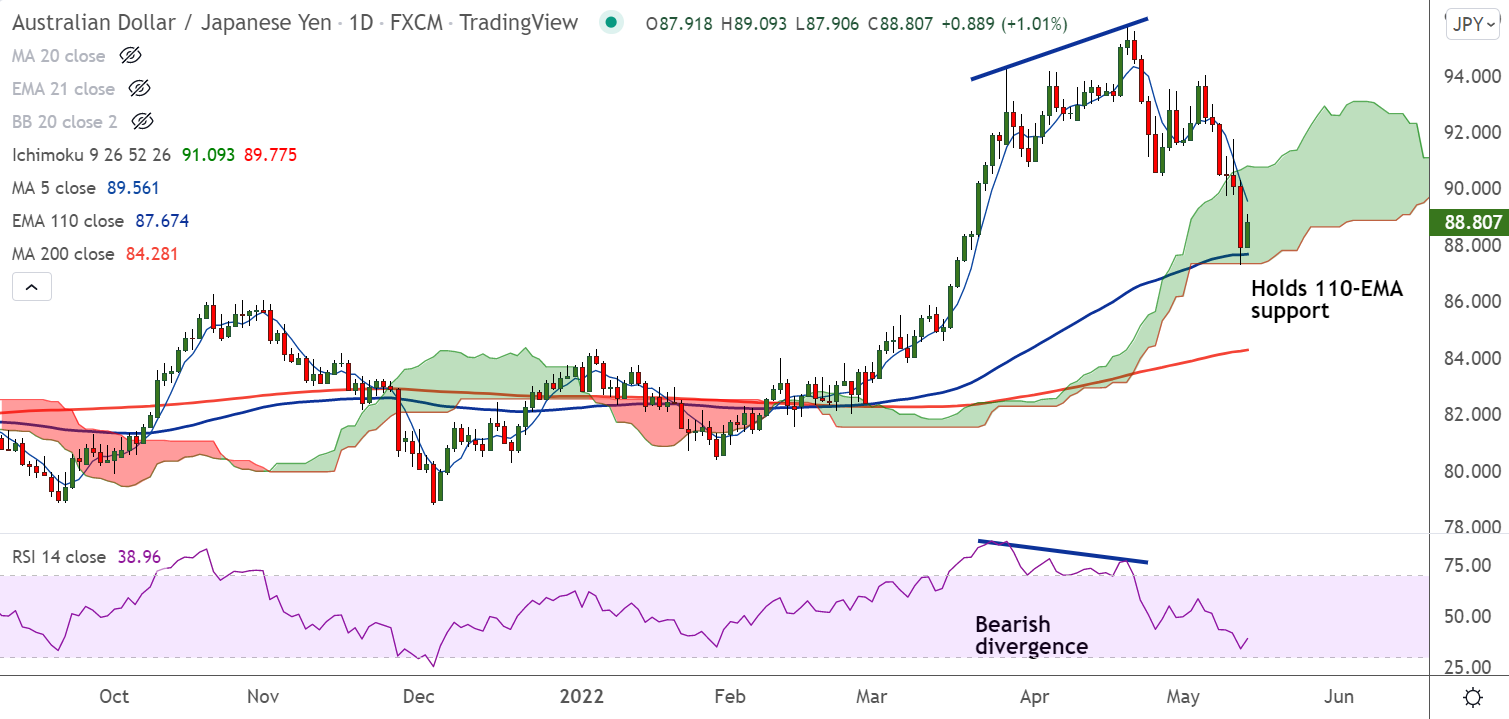

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- AUD/JPY was trading 0.94% higher on the day at 88.74 at around 12:30 GMT

- GMMA indicator shows major trend is neutral while minor trend has turned bearish

- The pair has paused downside at 110-EMA support, break below will drag the pair lower

- MACD and ADX support downside in the pair, bearish RSI divergence adds to downside bias

- Price action is inside the daily cloud and is holding cloud base support, break below cloud will plummet prices

Support levels:

S1: 87.67 (110-EMA)

S2: 84.28 (200-DMA)

Resistance levels:

R1: 89.56 (5-DMA)

R2: 89.98 (55-EMA)

Summary: AUD/JPY pivotal at 110-EMA support, break below will see more weakness.