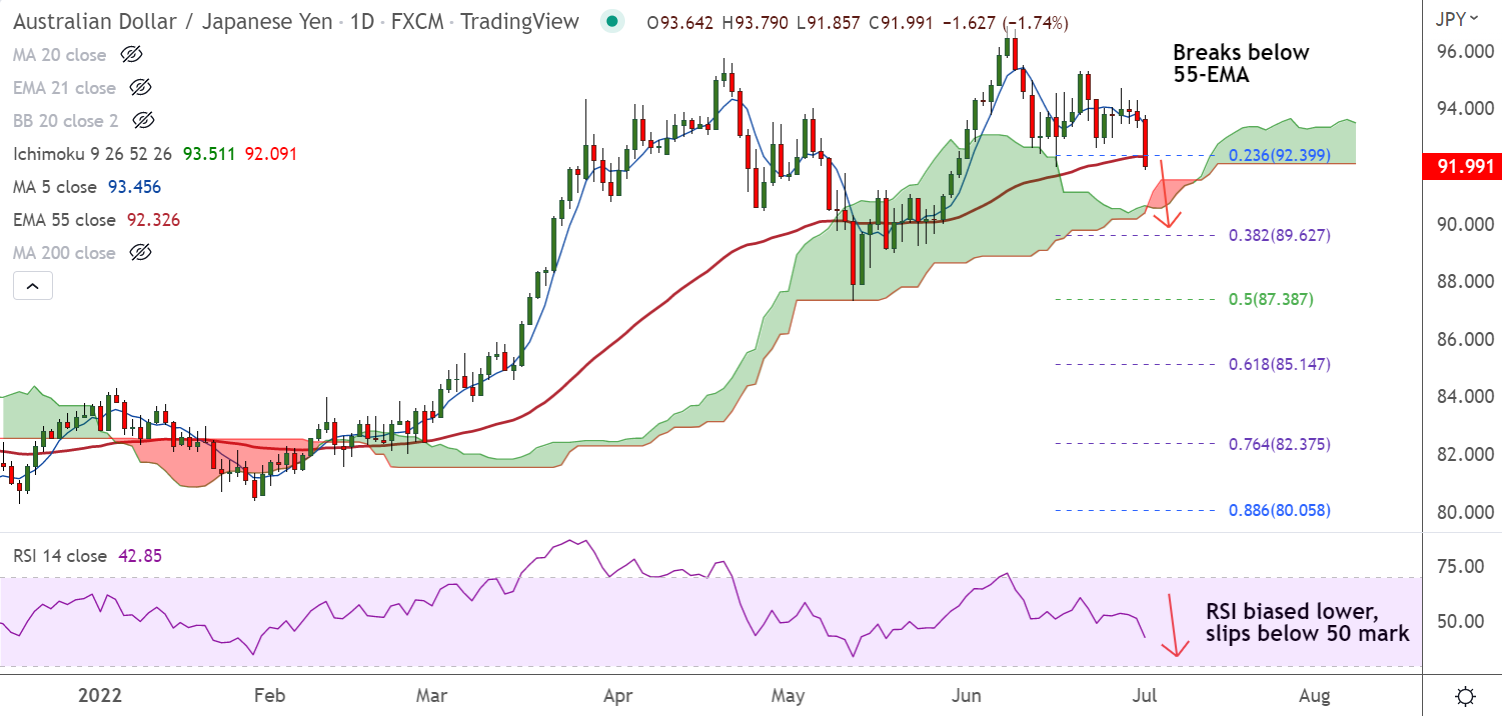

Chart - Courtesy Trading View

AUD/JPY was trading 1.52% lower on the day at 92.20 at around 10:30 GMT.

The pair has hit 4-week lows at 91.85, before paring some losses, outlook remains bearish.

Australian dollar largely ignores upbeat China Caixin Manufacturing PMI data, escalating fears of the economic slowdown fuel risk-off mood across the markets, dragging the pair lower.

China’s Caixin Manufacturing PMI rose to 51.7 for June versus 50.1 expected and 48.1 prior.

Technical bias is bearish. Price action has slipped below 55-EMA, the pair is on track to test cloud support.

Momentum is bearish, volatility is high and rising. Chikou span is biased lower.

Support levels - 91, 90.62 (Cloud top), 89.62 (38.2% Fib)

Resistance levels - 92.32 (nearly converged 23.6% Fib and 55-EMA), 93, 93.45 (5-DMA)

Summary: AUD/JPY trades with a bearish bias. Dip till daily cloud likely.