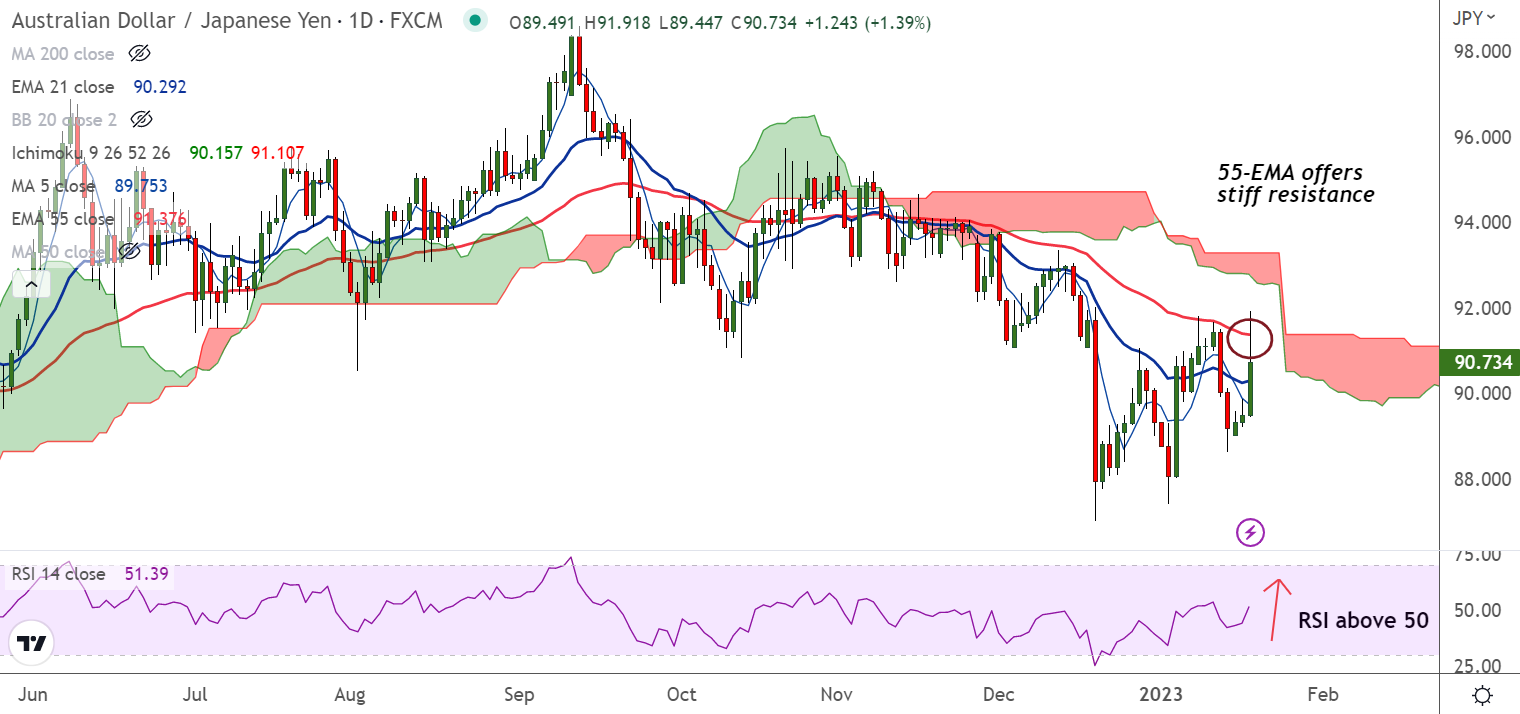

Chart - Courtesy Trading View

AUD/JPY was trading 1.46% higher on the day at 90.79 at around 11:30 GMT, down from session highs at 91.91 hit earlier in the day.

The Japanese yen was dumped across the board after the Bank of Japan (BoJ) unanimously decided to keep its yield curve controls in place.

The central bank maintained its short-term policy interest rate at negative 0.1%, and kept its long-term interest rate at 0%.

BoJ maintained ultra-low interest rates, including its 0.5% cap for the 10-year bond yield, defying market expectations it would phase out its massive stimulus programme.

The 10-year yield which had edged above the policy cap of 0.5% to an intraday high of 0.5100%, retreated sharply to 0.360% on Wednesday.

Focus now on Japan Nationwide consumer price index inflation data for December due Friday, expected to rise to 4% - twice the BOJ’s 2% annual target.

Traders also await Australian labour market data due on Thursday, where employment is seen rising a solid 22,500, while the jobless rate is seen near its lowest in half a century at 3.4%.

Technical bias for the pair is neutral. 55-EMA is major resistance at 91.37. Close above required to change near-term dynamics.