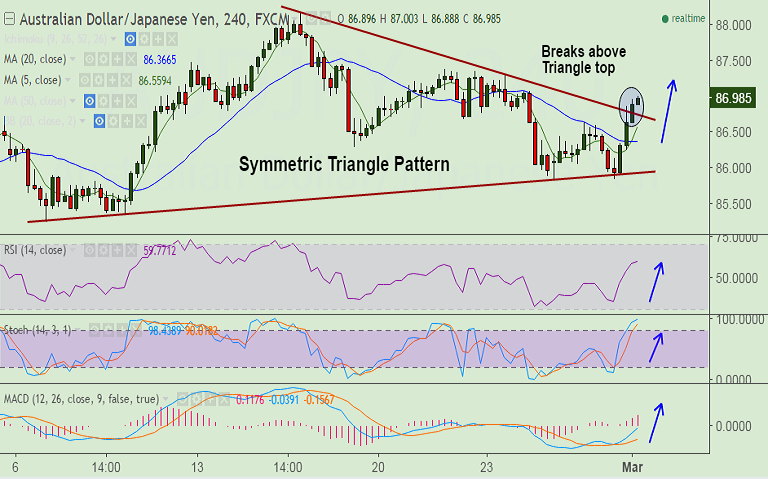

- AUD/JPY breaks above 'Symmetric Triangle' pattern, scope for further gains.

- Aussie buoyed on robust GDP data and upbeat China Caxin manufacturing PMI data.

- Australia Q4 GDP Q/Q increase to 1.1%, beating forecasts for 0.7% rise vs previous -0.5%.

- China's manufacturing activity gained momentum in February, Caixin manufacturing PMI rose to 51.7 last month from 51.0 in January.

- AUD/JPY has taken 50-DMA support at 85.85 on Tuesday and edged higher.

- The pair has broken above 20-DMA and hovers around 87 levels, intraday bias is higher.

- Technical studies support upside, we see weakness only on break below 50-DMA at 85.88.

Support levels - 86.65 (20-DMA), 86.52 (5-DMA), 85.88 (50-DMA)

Resistance levels - 87.53 (Dec 15 high), 88, 88.15 (Feb 15 high)

TIME TREND INDEX OB/OS INDEX

1H Bullish Overbought

4H Bullish Neutral

1D Neutral Neutral

1W Neutral Neutral

Recommendation: Good to go long on dips around 86.80/90, SL: 86.50, TP: 87.50/ 88/ 88.15

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 25.7785 (Neutral), while Hourly JPY Spot Index was at 5.57178 (Neutral) at 0650 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.