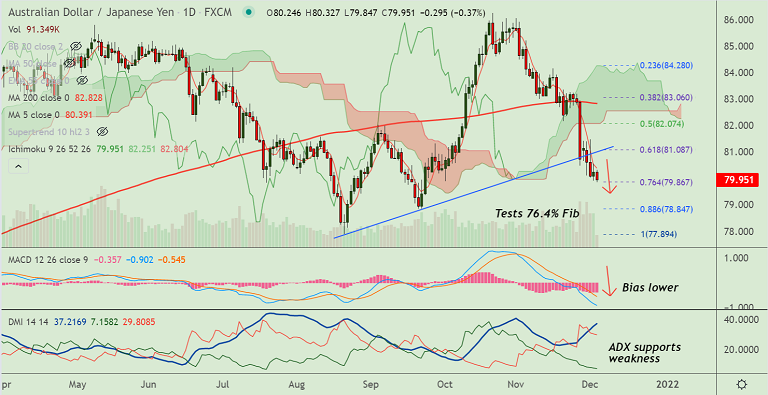

Chart - Courtesy Trading View

AUD/JPY was trading 0.36% lower on the day at 79.95 at around 11:25 GMT after closing 0.21% higher in the previous session.

The pair has tested 76.4% Fib retracement at 79.86, scope for further weakness. MACD and ADX support downside.

Data released earlier today showed Chinese Caixin Services PMI disappointed on the downside, undermining antipodeans.

Technical bias for the pair is strongly bearish. ADX and MACD support downside in the pair.

Momentum is favouring the bears, Stochs and RSI are sharply lower with scope for further weakness.

The pair is extending weakness after rejection at 200-month MA, and closing 5.93% lower in the previous month.

Support levels - 79.86 (76.4% Fib), 79.16 (Lower weekly cloud), 78.24 (200-week MA)

Resistance levels - 80.41 (5-DMA), 81, 81.50 (200H MA)

Summary: AUD/JPY trades with a bearish bias. Price action has tested 76.4% Fib at 79.86, breach below will see more downside. Scope for test of 200-week MA at 78.24.