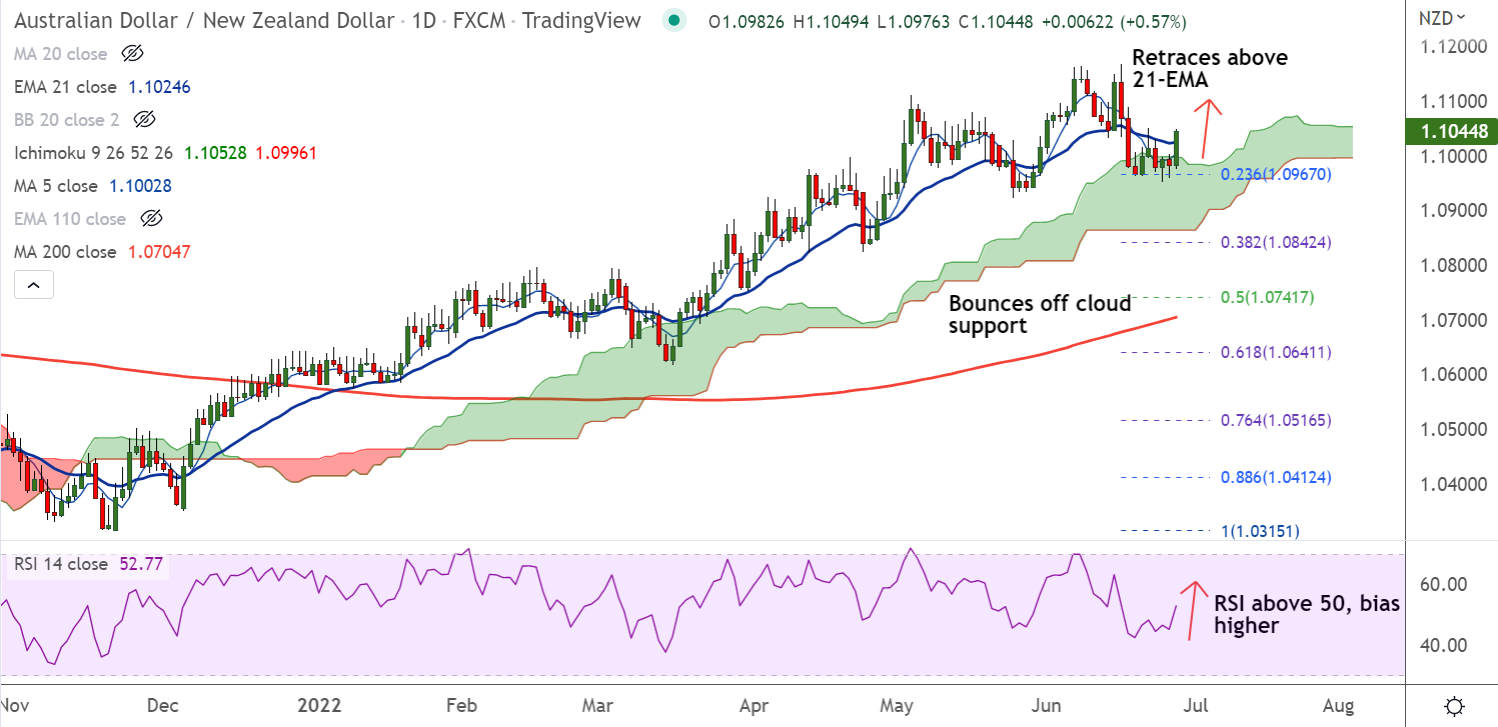

Chart - Courtesy Trading View

Technical Analysis:

- AUD/NZD was trading 0.60% higher on the day at 1.1049 at around 10:20 GMT

- The pair has bounced off cloud support and has broken past 21-EMA

- RSI is now biased higher and has edged above 50 mark

- Stochs are on verge of bullish rollover from oversold levels

- Price action has spiked above 200H MA, GMMA indicator has turned bullish on the intraday charts

Support levels:

S1: 1.1010 (200H MA)

S2: 1.0982 (55-EMA)

Resistance levels:

R1: 1.11

R2: 1.1155 (Upper W BB)

Summary: AUD/NZD has paused downside at daily cloud support. Retrace above 21-EMA raises scope for upside resumption.