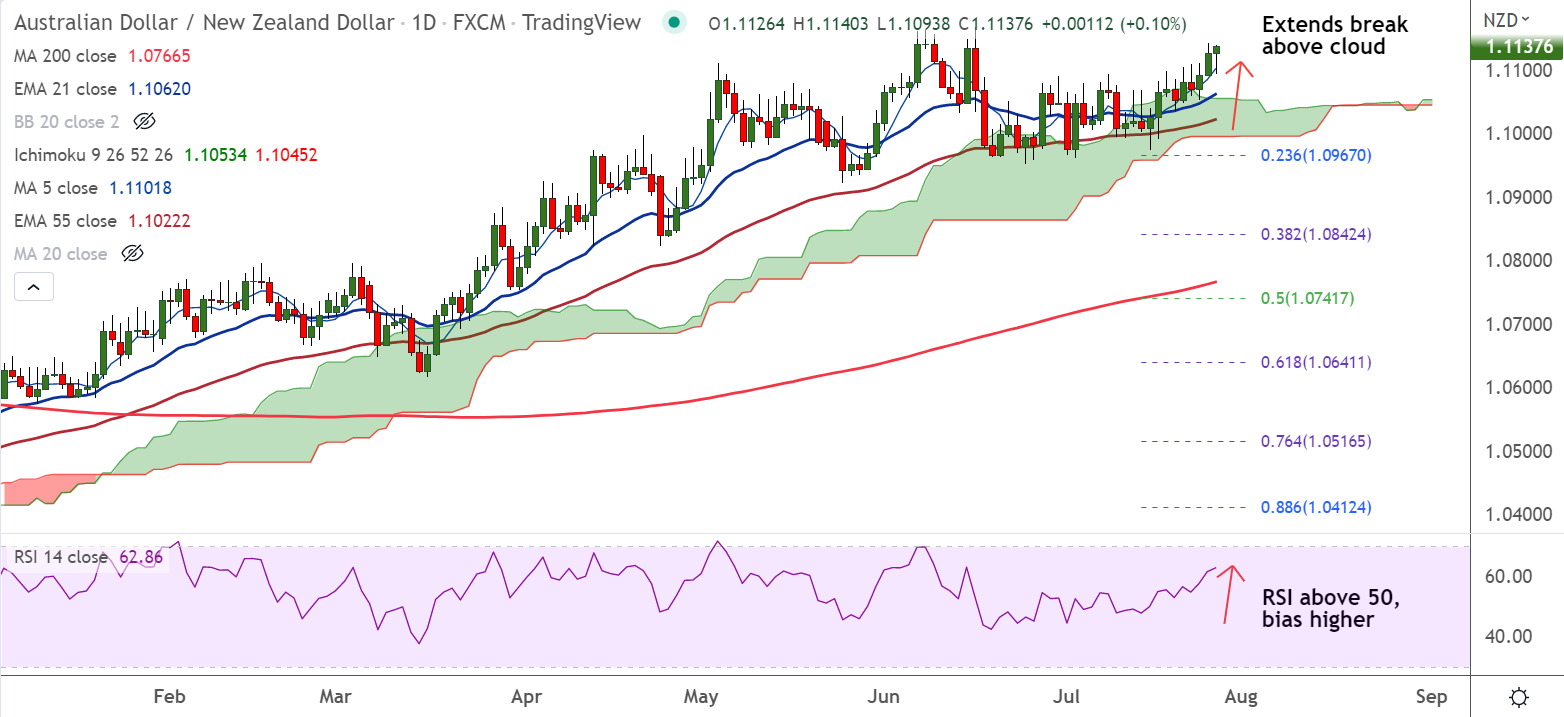

Chart - Courtesy Trading View

Technical Analysis:

- AUD/NZD was trading 0.10% higher on the day at 1.1137 at around 09:40 GMT

- The pair is extending break above daily cloud, outlook remains bullish

- Momentum is strongly bullish, Stochs and RSI are biased higher, RSI well above 50

- Volatility is high and rising as evidenced by wide Bollinger bands

- GMMA indicator shows major and minor trend are strongly bullish

Support levels:

S1: 1.1101 (5-DMA)

S2: 1.1062 (21-EMA)

Resistance levels:

R1: 1.1171 (Upper W BB)

R2: 1.12

Summary: AUD/NZD trades with a bullish bias. The pair is poised to refresh yearly highs above 1.1163. Bullish invalidation only below daily cloud.