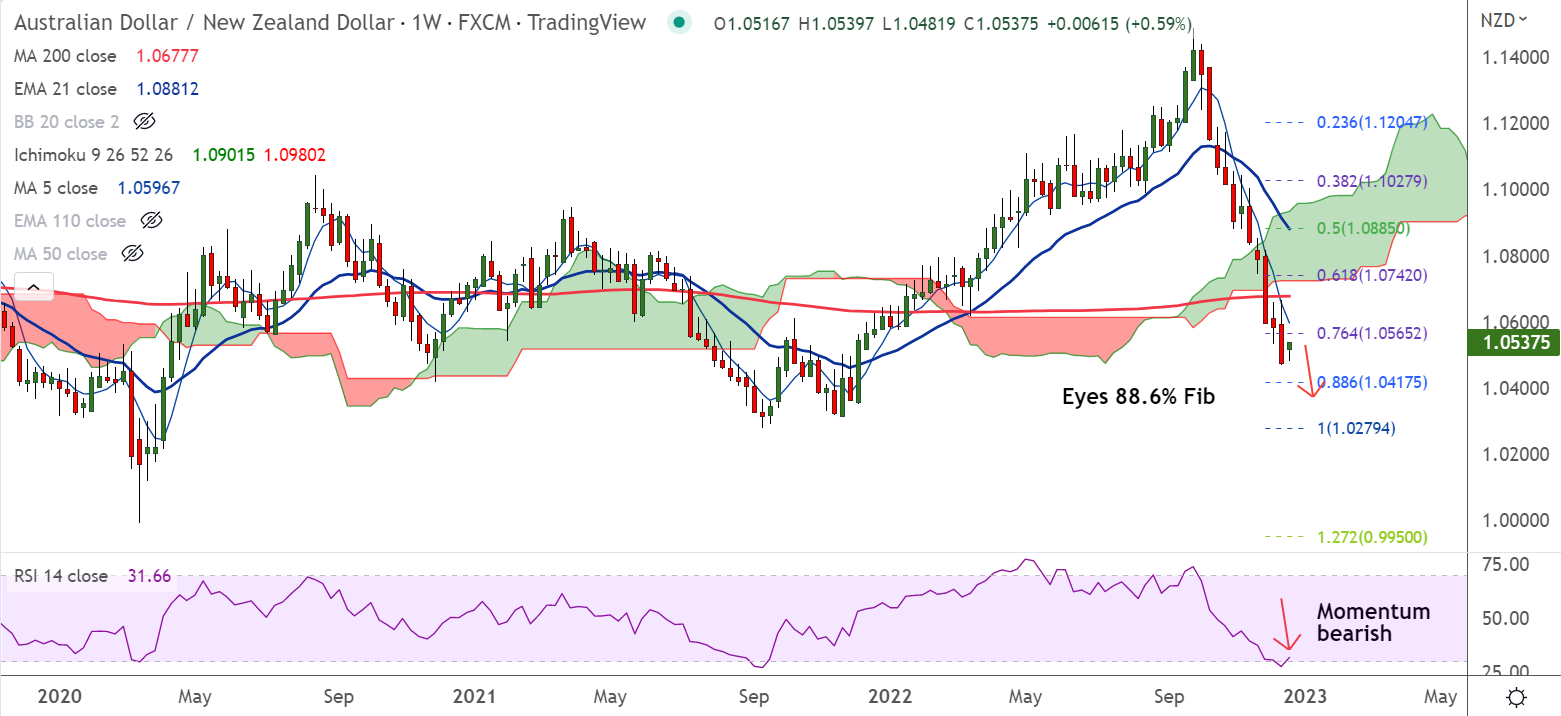

Chart - Courtesy Trading View

Technical Analysis:

- AUD/NZD was trading 0.59% higher on the day at 1.0538 at around 14:20 GMT

- The pair has retraced dip below major trendline support and has edged higher

- RSI is on verge of bullish rollover from oversold levels

- Price action is below major moving averages which are trending lower

- GMMA indicator shows major and minor trend are strongly bearish

Support levels:

S1: 1.0449 (Lower BB)

S2: 1.0417 (88.6% Fib)

Resistance levels:

R1: 1.0562 (5-DMA)

R2: 1.0663 (21-EMA)

Summary: AUD/NZD trades with a bearish bias. Oscillators are at oversold, but no major signs of reversal seen. Scope for test of 88.6% Fib at 1.0417. Bearish invalidation only above 200-DMA.