Fundamental Factors:

- The data released in New Zealand earlier today showed price increases for household purchases jumped above 1% for the first time in over two years.

- The uptick in inflation boosted RBNZ rate bets, despite which the currency pair failed to strengthen.

- Aussie extends its choppiness into mid-Asia as falling Chinese industrial profits dampen the sentiment around the Antipodean. China is Australia’s biggest trading partner.

- China's industrial profits in December rose 2.3% y/y, easing sharply from November's growth rate of 14.5%. This reflects that the profits increased at the slowest pace in a year.

Technical Analysis:

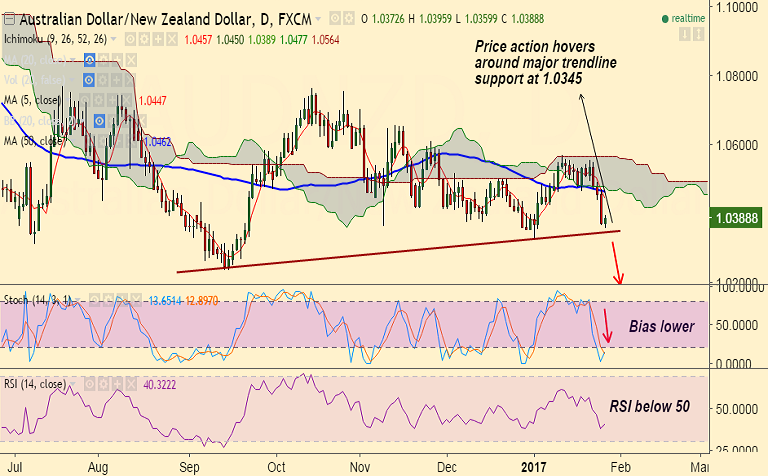

- AUD/NZD finds major trendline support at 1.0345, we see weakness only on break below.

- Price action dips below daily Ichi cloud, pair remains capped below 50-DMA.

- MACD line shows bearish crossover on signal line, Stochs and RSI are biased lower.

- The pair has edged higher from fresh 3-week lows at 1.3060, bias lower.

Support levels - 1.0355 (Jan 3 low), 1.0345 (trendline), 1.0327 (Jan 2 low)

Resistance levels - 1.0447 (5-DMA), 1.0462 (50-DMA), 1.0473 (20-DMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-NZD-breaks-below-daily-cloud-bias-lower-good-to-sell-rallies-502431) has almost achieved all targets.

Recommendation: Book full profits at lows. Fresh shorts recommended only on break below 1.0345.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -41.1898 (Neutral), while Hourly NZD Spot Index was at -1.99292 (Neutral) at 0450 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.