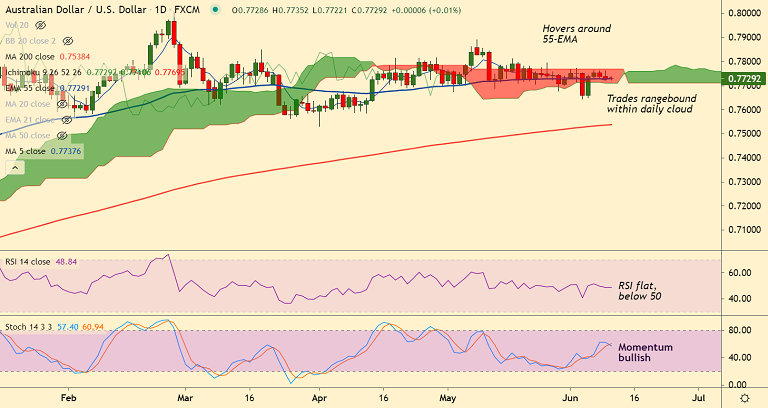

AUD/USD chart - Trading View

Commerce Heads of the US and China agreed to manage differences properly and affirmed to move forward on the trade and investment ties.

US-China news triggered minor pullback in AUD/USD. The pair paused 2 days of weakness and was trading marginally higher at 0.7730 at around 02:30 GMT.

As markets await crucial U.S. inflation data later today in the NY session, traders remain cautious and refrain from placing aggressive bets.

AUD/USD was range bound in the Asian session with session high at 0.7735 and low at 0.7722.

Technical bias for the pair remains neutral with the pair extending sideways grind along 55-EMA support.

Price action is confined within the daily cloud and volatility is also low as evidenced by narrow Bollinger bands.

Major Support Levels:

S1: 0.7710 (Cloud base)

S2: 0.7687 (21W EMA and Lower BB)

S3: 0.7671 (110-EMA)

Major Resistance Levels:

R1: 0.7741 (20-DMA)

R2: 0.7769 (Cloud top)

R3: 0.78 (Psychological mark)

Summary: The US CPI report (due Thursday) will provide fresh cues on the Fed’s next monetary policy action amid rising inflationary risks. The FOMC will be meeting on June 17th and any hints about taper will probably put upwards pressure on the U.S dollar, supporting upside in the pair.