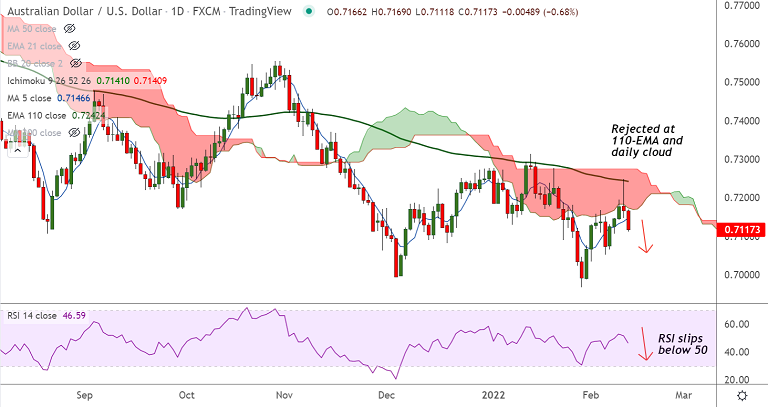

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.60% lower on the day at 0.7123 at around 05:30 GMT

Previous Week's High/ Low: 0.7168/ 0.6987

Previous Session's High/ Low: 0.7248/ 0.7146

Fundamental Overview:

Red-hot U.S. inflation data and hawkish Fed comments fueled bets on aggressive U.S. interest rates hikes, boosting the US dollar.

Data on Thursday showed U.S consumer prices surged 7.5% in Jan on a year-over-year basis, beating estimates of 7.3% and marking the biggest annual increase in inflation in 40 years.

Further, St. Louis Federal Reserve Bank President James Bullard said the data had made him "dramatically" more hawkish.

On the other side, RBA’s Lowe keeps turning down hopes of a rate hike in his testimony. Says RBA will wait until they have evidence that inflation has picked up in a sustainable way.

Technical Analysis:

- AUD/USD rejected at daily cloud

- Spinning top formed on the daily charts at cloud resistance

- The pair retraces break above 200-week MA

- Price action has slipped below 200H MA

Major Support and Resistance Levels:

Support - 0.7033 (Monthly low), Resistance - 0.7142 (21-EMA)

Summary: AUD/USD bias tilted bearish after upside was rejected at 110-EMA and cloud resistance. Scope for test of yearly lows at 0.6967.