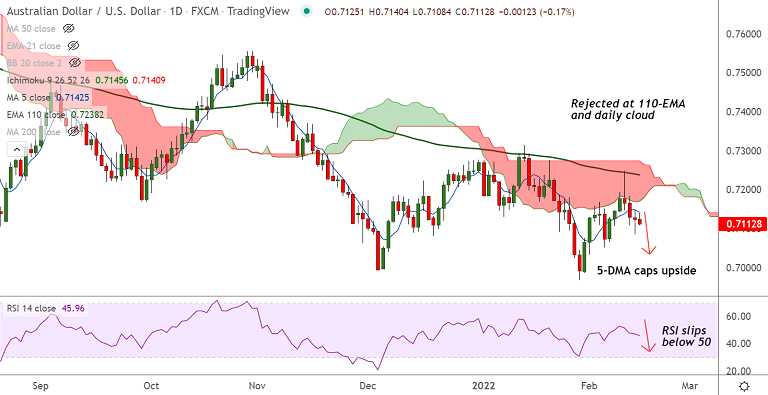

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- AUD/USD was trading 0.21% lower on the day at 0.7109 at around 05:25 GMT

- Upside remains capped at 21-EMA resistance, the pair is extending weakness for the 4th straight session

- GMMA indicator shows major trend is bearish, while minor trend is turning bearish

- Momentum indicators are bearish on the daily charts. RSI has slipped below 50 and Stochs have turned

- Price action is well below the daily cloud and Chikou span is biased lower

Support levels - 0.7096 (5-week MA), 0.7051 (38.2% Fib), 0.70

Resistance levels - 0.7128 (20-DMA), 0.7155 (200-week MA), 0.7176 (55-EMA)

Summary: AUD/USD trades with a bearish bias, scope for test of 0.70 level. Bearish invalidation only above 55-EMA.