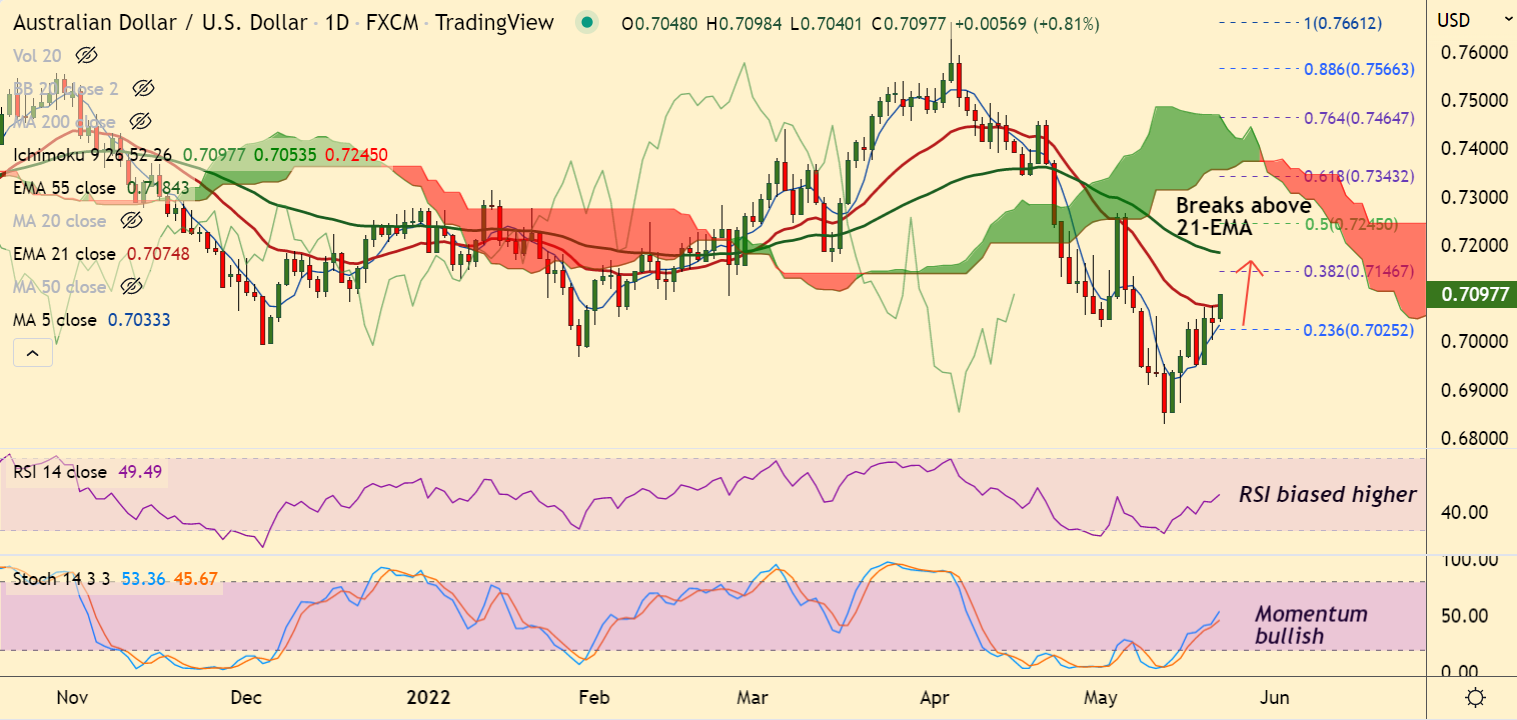

Chart - Courtesy Trading View

AUD/USD was trading 0.85% higher on the day at 0.7099 at around 05:45 GMT, after closing largely unchanged in the previous session.

Aussie buoyed amid improving risk sentiment, AUD/USD breaks above 21-EMA, outlook turns bullish.

Markets turn hopeful that loosening lockdowns in China can help global growth and exporters' currencies.

Technical indicators are turning bullish. Stochs and RSI are sharply higher. Chikou span is biased higher.

Price action has broken above 200H MA and GMMA indicator has turned bullish on the intraday charts.

Major Support Levels:

S1: 0.7076

S2: 0.7037

Major Resistance Levels:

R1: 0.7146 (68.2% Fib)

R2: 0.7185 (55-EMA)

Summary: AUD/USD breakout above 21-EMA has raised scope for further gains. Next bull target lies at 38.2% Fib at 0.7146.