Chart - Courtesy Trading View

AUD/USD was trading 0.12% higher on the day at 0.6929 at around 04:35 GMT.

Australia’s Roy Morgan Business Confidence index fell for the second straight month to lowest levels since September 2020.

Australia’s Business Confidence index printed at 97.3 for June, from 100.2 in the previous month.

Global rating agency S&P cuts Australia’s 2022 GDP forecast to to 3.6% (from 4% previously), 2023 projection is 2.8% (2.7% prior forecast).

The rating giant also expects further interest rate hikes to 1.75% this year, 2.5% in 2023, 2.75% in 2024 while a cut to 2.5% in 2025.

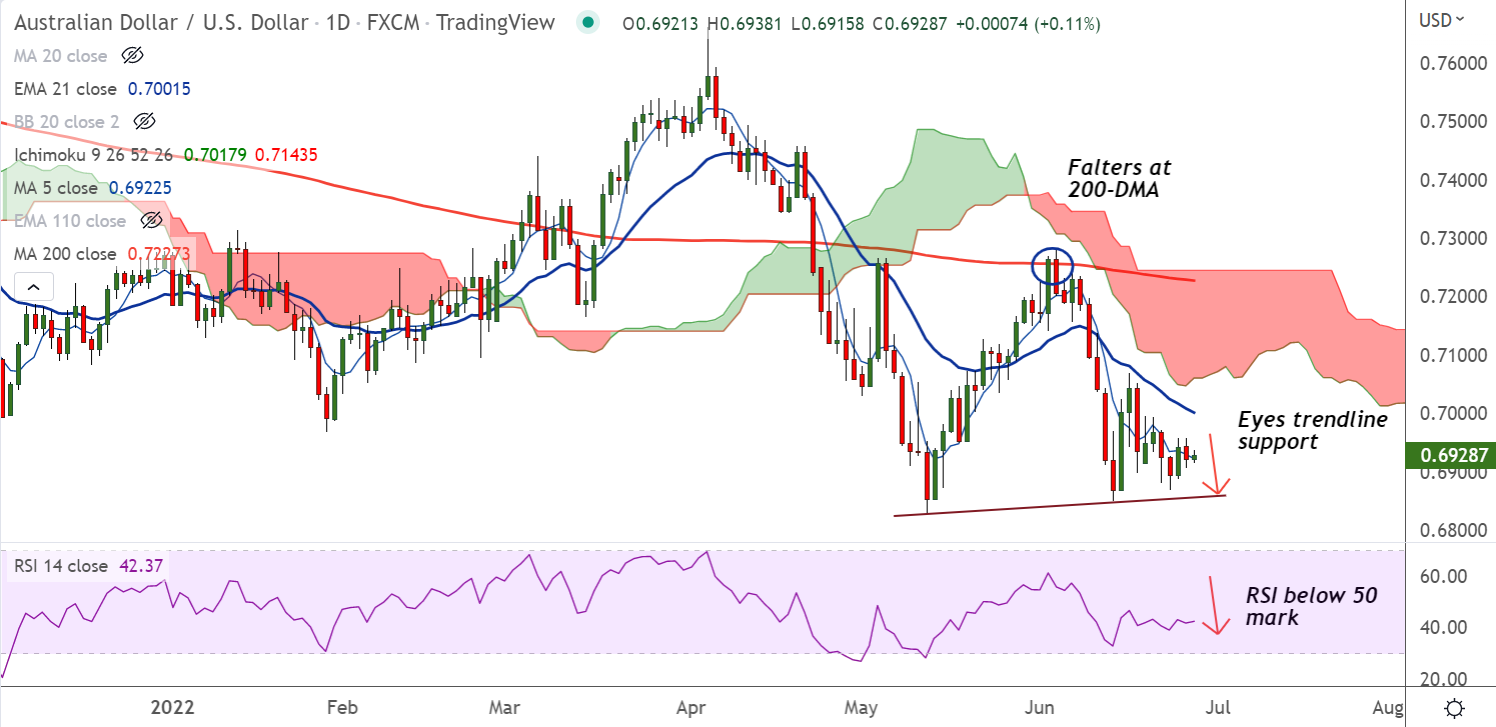

Technical Analysis:

- GMMA indicator shows major and minor trend are strongly bearish

- Momentum is bearish, volatility is high and rising

- Price action is below major moving averages which are trending lower

- ADX and MACD support weakness in the pair

Major Support Levels: 0.6850 (Monthly low), 0.6782 (Lower BB)

Major Resistance Levels: 0.6947 (200H MA), 0.7001 (21-EMA)

Summary: AUD/USD was trading with a bearish bias. Scope for test of trendline support at 0.6855. Bearish invalidation above 21-EMA.