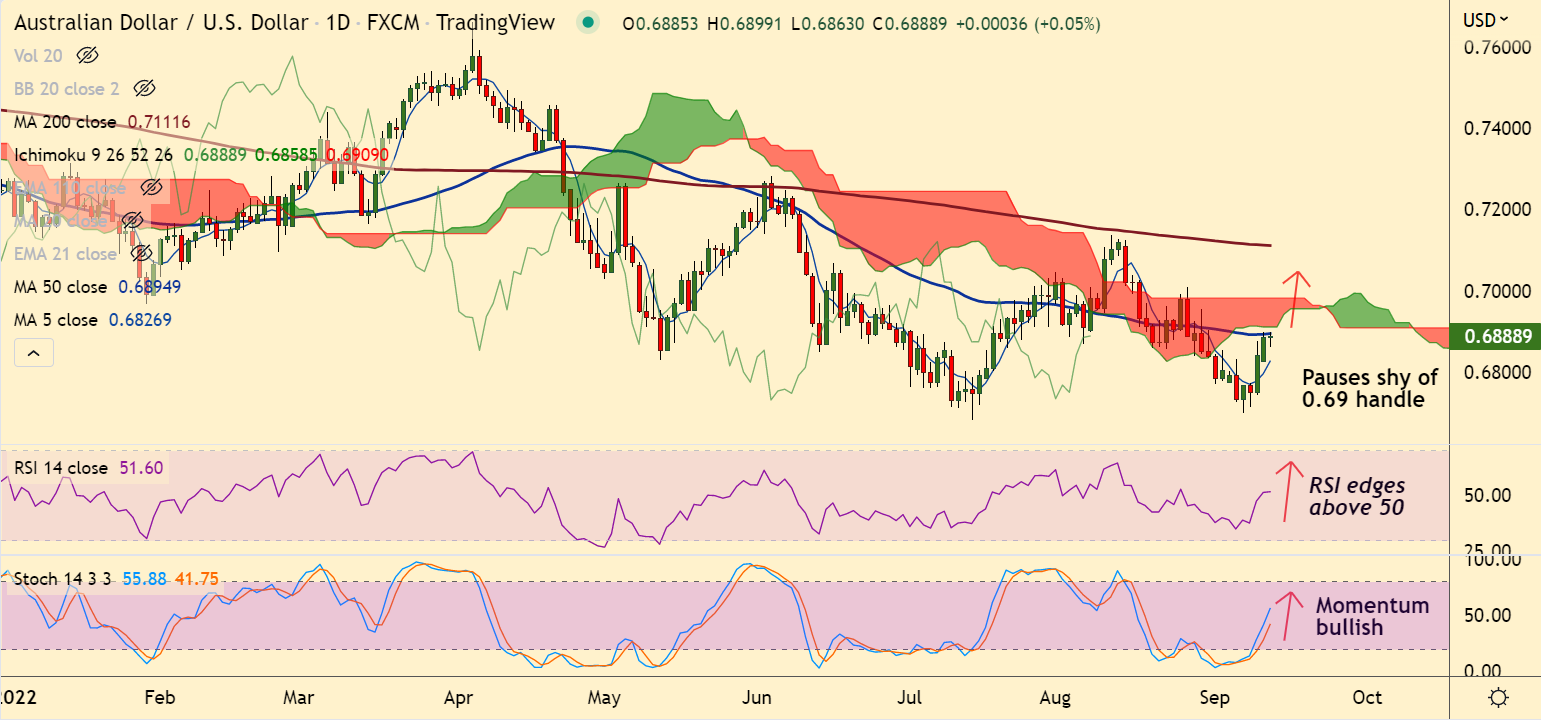

Chart - Courtesy Trading View

AUD/USD trades rangebound with session highs at 0.6748 and lows at 0.6705 as the pair consolidates previous session's slump.

The pair plunged over 150 pips on Tuesday after US inflation data exceeded estimates, strengthening the odds of a third consecutive 75 bps rate hike by the Fed.

On the other side, Australia Business Consumer Confidence data increased 1 point to +20 in August, according to the National Australia Bank (NAB).

The survey showed that prices eased in August to 4.4% from a record high of 5.3% in July

Focus now on Thursday’s Australia jobs report and Friday’s speech from the Reserve Bank of Australia (RBA) Governor Philip Lowe for impetus.

Thursday’s August month US Retail Sales and Friday’s preliminary reading of the Michigan Consumer Sentiment Index for September will also be important for direction.

Technical bias is bearish. Recovery was rejected at 55-EMA, scope for further downside. The pair is poised to refresh yearly lows below 0.6681.