AUD/USD chart - Trading View

AUD/USD was trading largely unchanged at 0.7718 at around 08:25 GMT after closing 0.70% lower in the previous session.

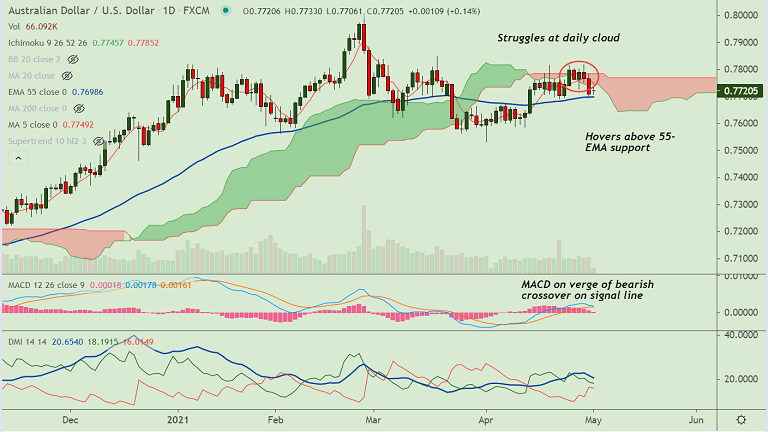

The pair is hovering above 55-EMA support at 0.7698, technicals suggest scope for more weakness.

Data released earlier in the day in Australia showed Australian Industry Group (AIG) manufacturing index for April was at 61.7, higher than March’s 59.9 reading.

The remains remains under pressure amid broad-based U.S dollar strength. Strong U.S. consumption figures, including personal spending, boosted the greenback.

Technical analysis for the pair points to a bearish tilt. Price action has been rejected at daily cloud and has slipped below 200H MA.

Stochs show a bearish rollover from overbought levels and MACD is on verge of bearish crossover on signal line.

The Reserve Bank of Australia (RBA) policy rate decision will be closely watched as tame inflation could warrant a potential tweak to the 3-year bond target.

The RBA is widely expected to stay pat on Tuesday, but focus will be on speech by deputy RBA governor Guy Debelle on Thursday for clues into the central bank’s bond purchases outlook.

U.S. data, including the Institute of Supply Management (ISM) Manufacturing Purchasing Managers index and non-farm payrolls for April, will also be in focus this week.

Break below 55-EMA support will accentuate weakness in the pair. Scope for dip till 110-EMA at 0.7619.