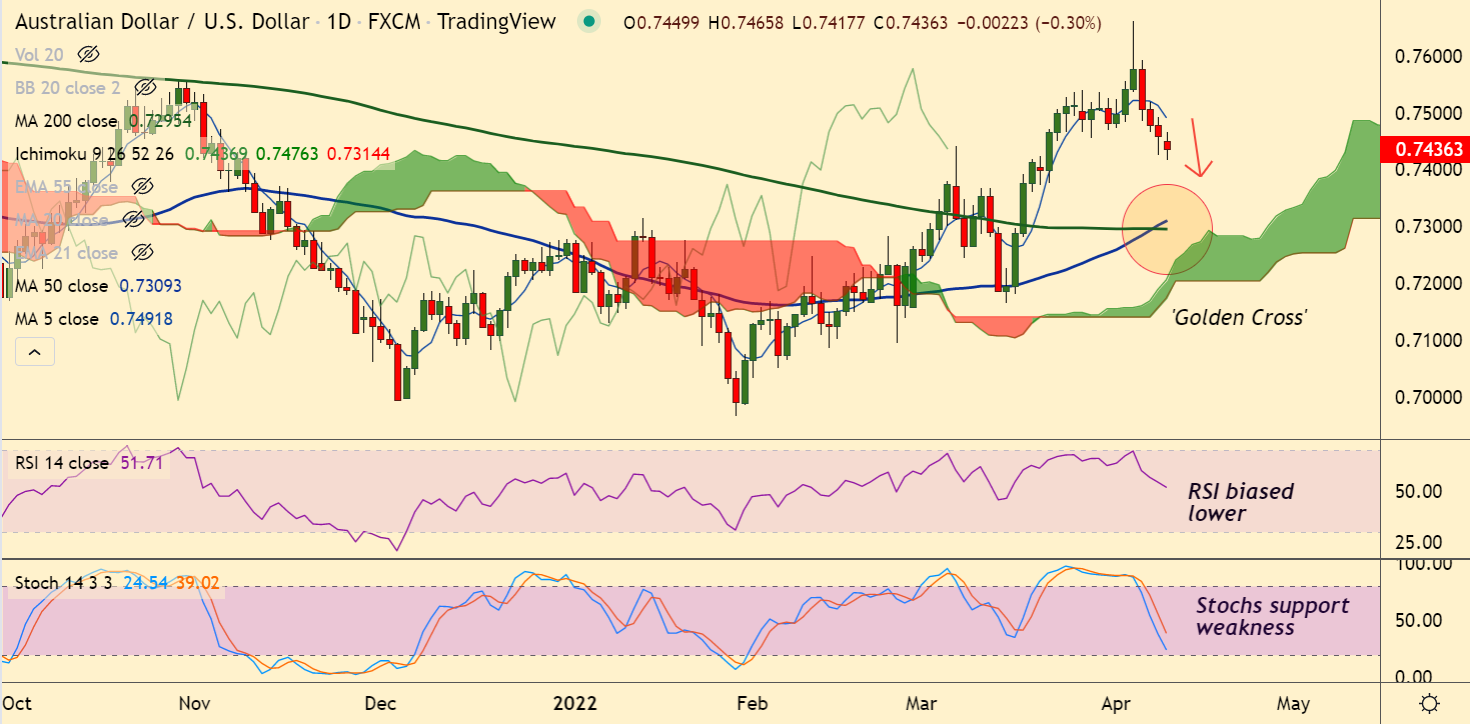

Chart - Courtesy Trading View

AUD/USD was trading 0.32% lower on the day at 0.7434 at around 09:00 GMT.

The pair is extending bearish streak for the 4th consecutive session, slips below 21-EMA.

Antipodeans depressed after China CPI and PPI data released earlier on Monday stoked stagflation fears in the Chinese economy.

Data from the National Bureau of Statistics showed that China’s consumer price index for March grew 0% m/m, above forecasts at -0.1% and compared to the previous month’s growth at 0.6%.

CPI grew 1.5% y/y, also beating estimates at 1.2% and the previous month’s 0.9% growth.

China's producer price index grew 8.3% y/y, as compared to forecasts at 7.9% growth and 8.8% recorded during the previous month.

On the other side, the US dollar remains bid ahead of Tuesday's CPI data. Estimates are on the higher side at 8.3%, which if true will add pressure on the Fed to adopt a tight policy environment.

Technical indicators support further weakness in the pair. MACD confirms bearish crossover on signal line.

Price action has slipped below 21-EMA, Chikou span is biased lower. Momentum is with the bears. Stochs and RSI are sharply lower.

That said, 'Golden Cross' (bullish 50-DMA crossover on 200-DMA) suggests downside is likely to be limited.

Major support levels are seen at 0.7347 (55-EMA), 0.7311 (110-EMA), 0.7295 (200-DMA). While major resistance levels align at 0.7445 (21-EMA), 0.7492 (5-DMA), 0.75.