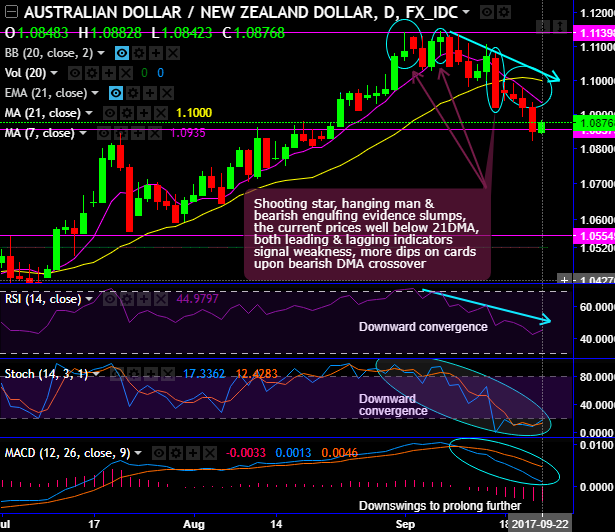

On daily terms, the stiff resistance is seen at 1.1144 levels.

That is where, a few set of bearish pattern candlesticks, such as, Shooting star, hanging man & the bearish engulfing candle at 1.1083, 1.1126, 1.0921 levels respecpectively.

As a result, these bearish patterns evidence slumps, the current prices are well below 21DMA despite today’s rallies.

Both leading & lagging indicators signal weakness, RSI and stochastic curves that indicate strength and momentum in the trend have been consistently converging downwards to the price dips.

For now, more dips seem to be on cards as 7DMA crosses below 21DMA which is a bearish DMA crossover. While another lagging oscillator (MACD) also signals downswings to prolong further.

On the flips side, it has tested strong support at 1.0857 levels for today, but no substantiation is observed from any other indicators, so, it shouldn’t be studied in an isolation.

The major trend has been sliding in sloping channel (refer monthly charts), the current prices spike above EMAs but attempt to slide back in sloping channel.

Overall, the resumption of major downtrend is on the table, even if you any abrupt upswings, that shouldn’t be deemed as panicky sentiment.

Thus, contemplating above technical rationale, on speculative grounds we advocate boundary binaries with upper strikes at 1.0937 (7DMA) and lower strikes at 1.0857 levels (strong support).

The trading between these strikes likely to derive certain yields and more importantly these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1.0937 > Fwd price > 1.0857).

Alternatively, with a view to arrest downside risks, foreign traders are advised to initiate shorts in futures contracts of near-month tenors.

Currency Strength Index: Ahead of NZ parliamentary polls, FxWirePro's hourly NZD spot index is flashing at -103 levels (which is highly bearish), while hourly AUD spot index was at shy above -32 (which is mildly bearish) while articulating. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary