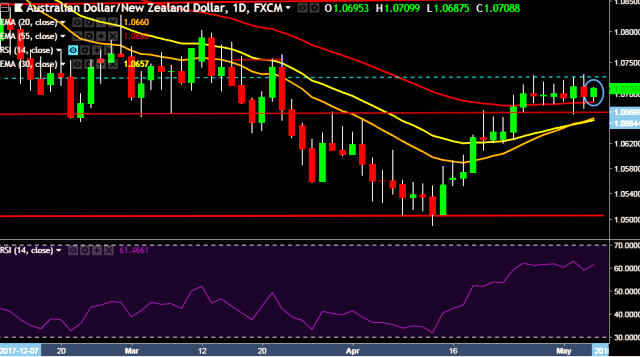

- AUD/NZD is currently trading around 1.0716 marks.

- Pair made intraday high at 1.0718 and low at 1.0687 marks.

- Intraday bias remains slightly bullish till the time pair holds key support at 1.0665 mark.

- A sustained close above 1.0710 will drag the parity higher towards key resistances at 1.0757/1.0802/1.0945/1.1072 levels respectively.

- Alternatively, a daily close below 1.0692 will take the parity down towards key supports around 1.0624/1.0572/1.0506/1.0443/1.0380/1.0305 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart. Current upside movement is short term trend correction only.

- Australia's S&p/ASX 200 index up 0.04 pct at 6,100.80 points in early trade.

- RBA quarterly statement - Board sees no strong case for near-term move in cash rate.

- RBA - A "significant" appreciation in the A$ would dampen growth and inflation.

- RBA - Unemployment forecast at 5.5 pct end 2018 (from 5.25 pct), 5.25 pct out to mid-2020.

- RBA - Business conditions "very positive", sees further solid growth in non-mining investment.

- RBA - GDP growth forecast at 3.25 pct Dec 2018 and Dec 2019, 3 pct by mid-2020.

- RBA - Underlying inflation forecast at 2 pct Dec 2018 to dec 2019, rising to 2.25 pct by mid-2020.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest