Horizontal trend line- $605

BNBUSD consolidating after a minor sell-off.

Any daily close above $605 confirms further bullishness.

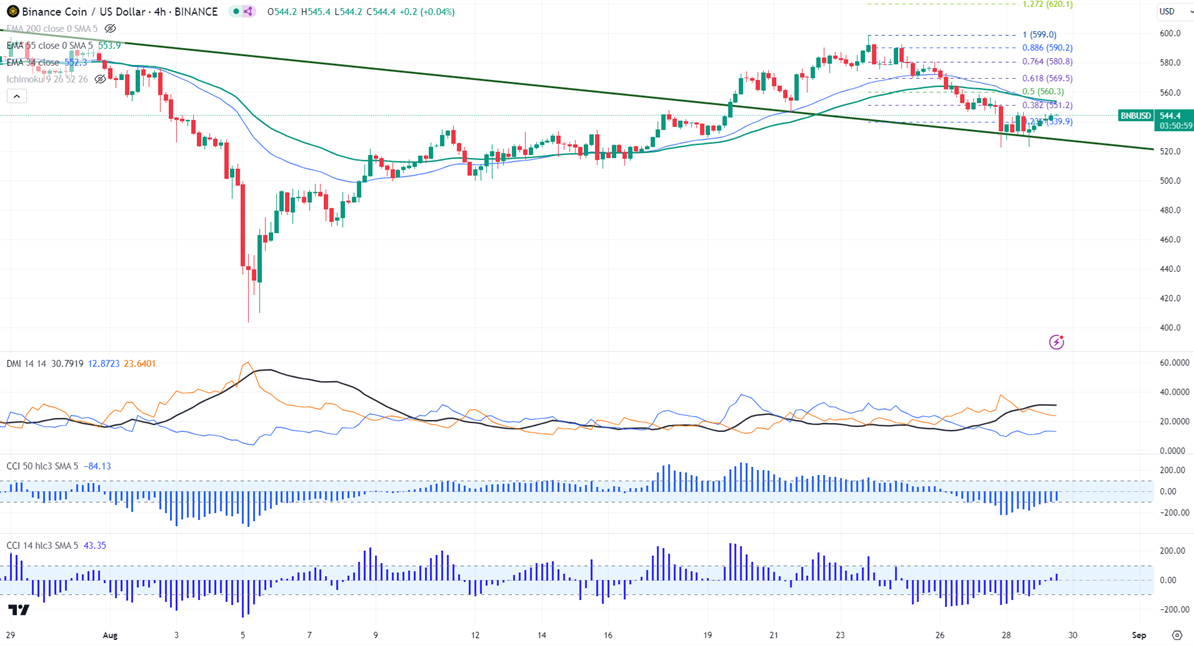

BNBUSD formed a double bottom around $520.The pair holds below the short-term (34 and 55 EMA) and long-term moving average in the 4-hour. It hit a high of $545.80 at the time of writing and is currently trading around $545.

The bullish invalidation can happen if the pair closes below $400. On the lower side, the near-term support is $519.80 (200-day EMA). Any break below targets $500/$460.

The immediate resistance stands at around $553. Any breach above confirms minor bullishness. A jump to $560/$569/$580/$600 is possible. A surge past $605 will take it to $700.

Indicators ( 4- hour chart)

Directional movement index -Bearish

CCI (50)- Bearish

CCI(14)- Bullish

It is good to buy on dips around $520 with SL around $470 for TP of $605.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary