Horizontal trend line- $605

BNBUSD trades flat with an intraday bias bearish.

Any daily close above $605 confirms further bullishness.

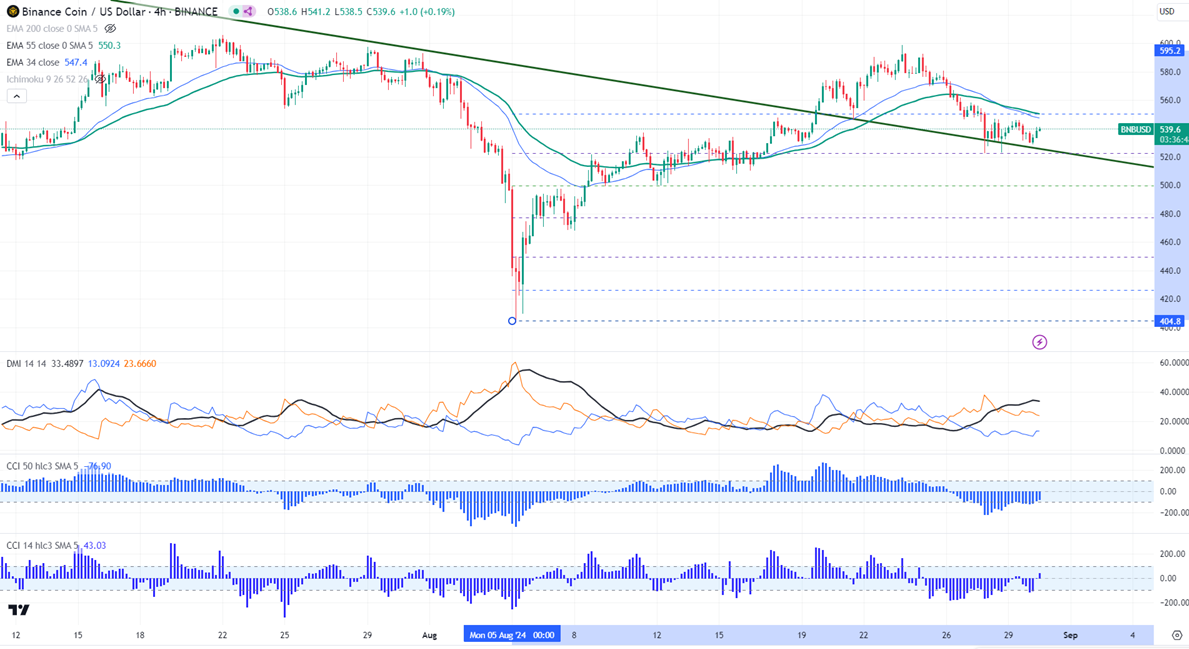

BNBUSD has taken support near the 200-day EMA and showed a minor pullback. The pair holds below the short-term (34 and 55 EMA) and long-term moving average in the 4-hour. It hit a high of $575 this week and is currently trading around $540.70.

The bullish invalidation can happen if the pair closes below $403 (Aug 5th low). On the lower side, the near-term support is $519.80 (200-day EMA). Any break below targets $500/$460/$449.

The immediate resistance stands at around $553. Any breach above confirms minor bullishness. A jump to $569/$580/$600 is possible. A surge past $605 will take it to $700.

Indicators ( 4- hour chart)

Directional movement index -Bearish

CCI (50)- Bearish

CCI(14)- Bullish

It is good to buy on dips around $520 with SL around $470 for TP of $605.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary