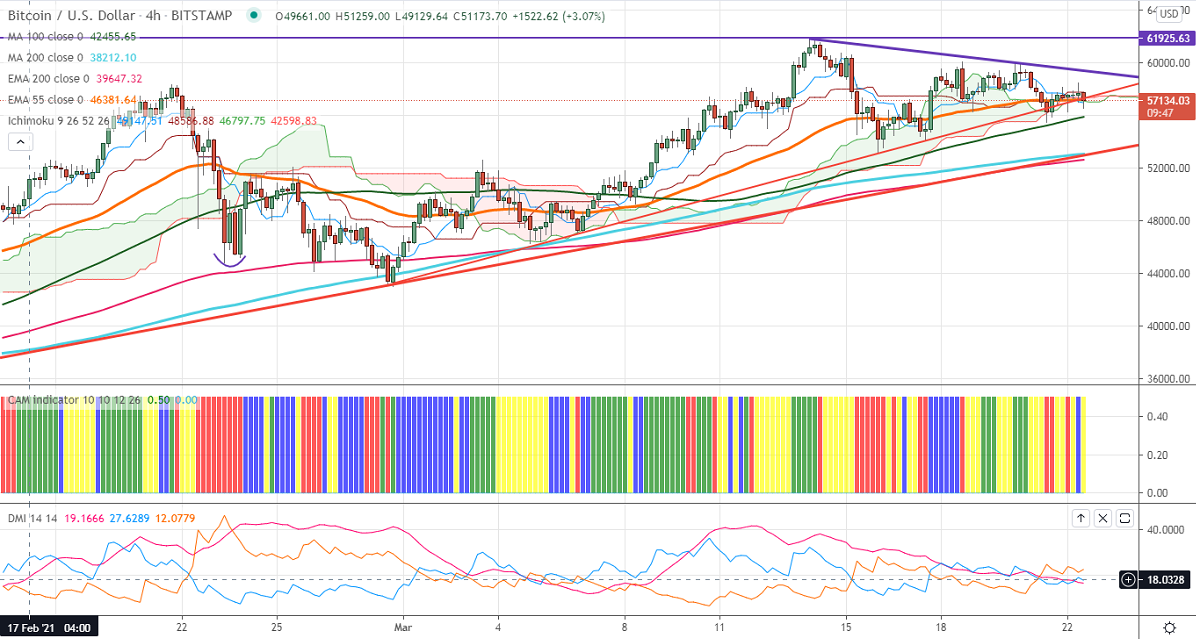

Ichimoku analysis (4-hour chart)

Tenken-Sen- $58181

Kijun-Sen- $56908

BTCUSD is consolidating in a narrow range between $61700 and $53221 for the past week. The pair jumped to $59957 on Friday and started to decline from that level. The overall trend is slightly on the lower side, as long as resistance $62000 holds. The pair is holding below 4 Hour Tenken-Sen and Kijun-Sen. Any violation below $55500 confirms minor bearishness, a dip till $54000/$53220 is possible. On Mar 16th, 2021 the pair formed a minor bottom around $53000.This confirms shows that BTCUSD must close below $53000 for further minor weakness.

The pair's near-term resistance is around $58500.Any violation above confirms intraday bullishness. A jump till $60000/$62000 is possible.

Indicator (4 Hour chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to sell on rallies around $58500 with SL around $60000 for TP of $53000/$50000.