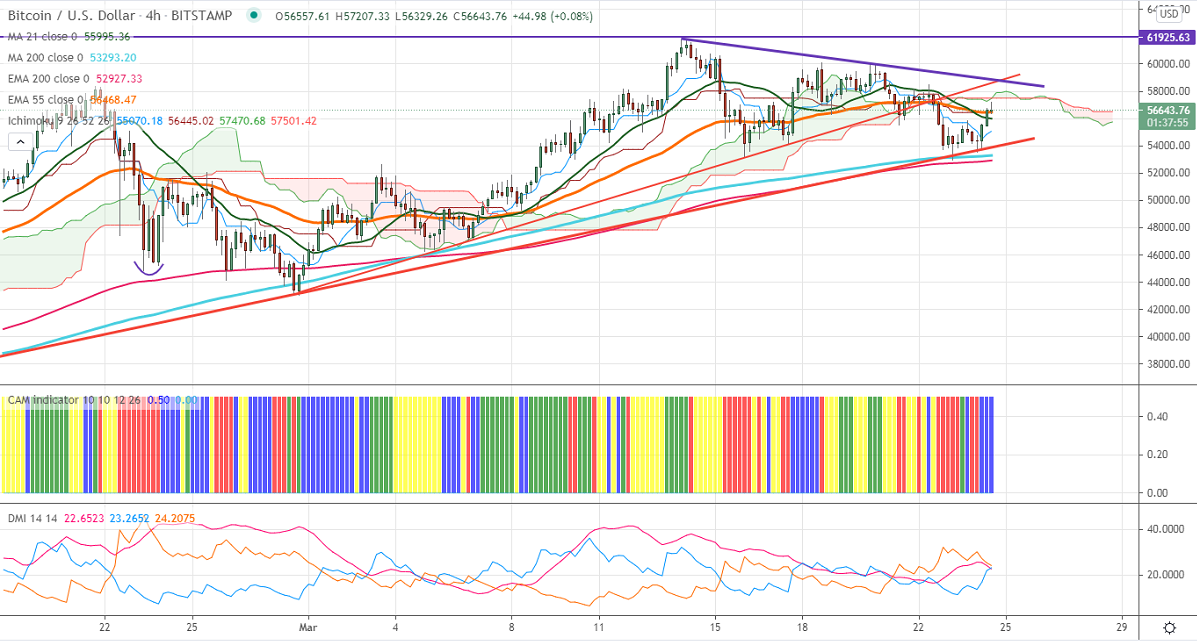

Ichimoku analysis (4-hour chart)

Tenken-Sen- $54854

Kijun-Sen- $56445

BTCUSD has once again recovered sharply after taking support near 200-4H MA. Bitcoin surged more than 5% after Tesla announced that it accepts cryptocurrency as payment. The intraday trend is slightly on the higher side, as long as support $53000 holds. The pair is holding above 4 Hour Tenken-Sen and Kijun-Sen. Any violation below $55500 confirms minor bearishness, a dip till $54000/$53000 is possible.

The pair's near-term resistance is around $58500.Any indicative break above will take the pair to next level till $60000/$61800.Significant trend continuation can happen only if it breaks $62000.A jump till $64270/$67275 is possible.

Indicator (4 Hour chart)

CAM indicator –Neutral

Directional movement index – Neutral

It is good to buy on dips around $54000 with SL around $53000 for TP of $59800.