Ichimoku analysis (4-hour chart)

Tenken-Sen- $54874

Kijun-Sen- $54037

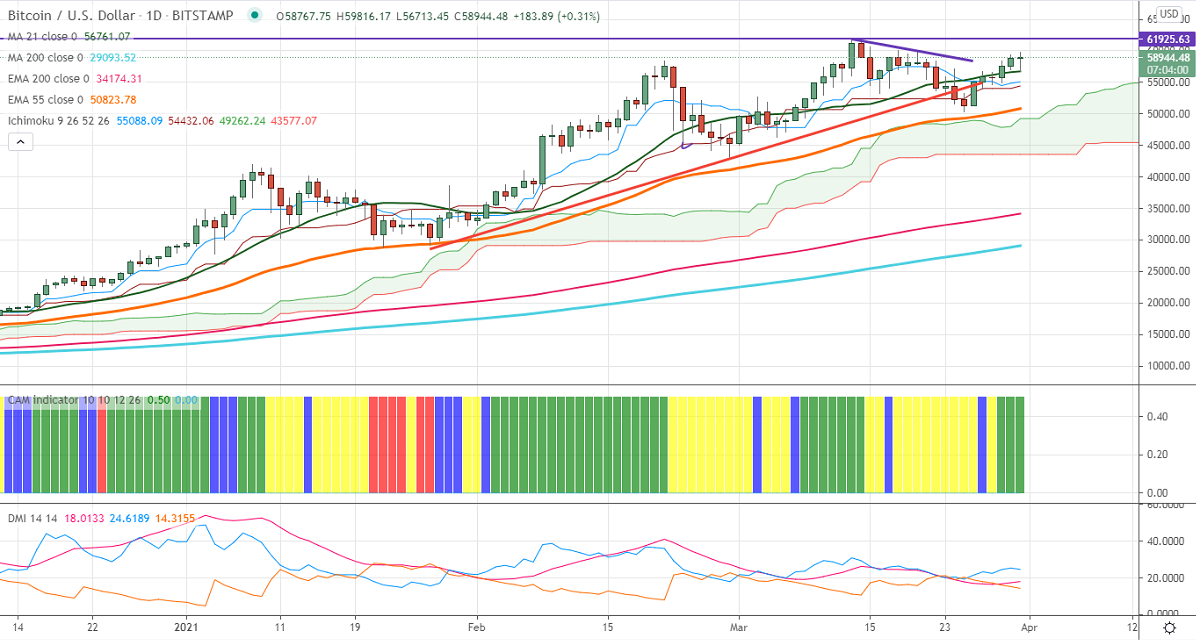

BTCUSD has taken support near 21- day MA and recovered more than $2000. The pair is holding well above the short term (21 and 50 day MA) and long term moving average (100 and 200- day MA). The intraday trend is still bullish as long as support $56500 holds. significant weakness only if it closes below the $49300 level. It hits an intraday high of $59814 and is currently trading around $59092.

On the higher side, near-term resistance is around $60000. Any violation above targets $61700. Major trend continuation only above $62000.

The pair's near-term resistance is around $56500.Any violation below will drag the pair down till $55500/$54870 is possible.

Indicator (Daily chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around $57000 with SL around $55000 for TP of $61700.