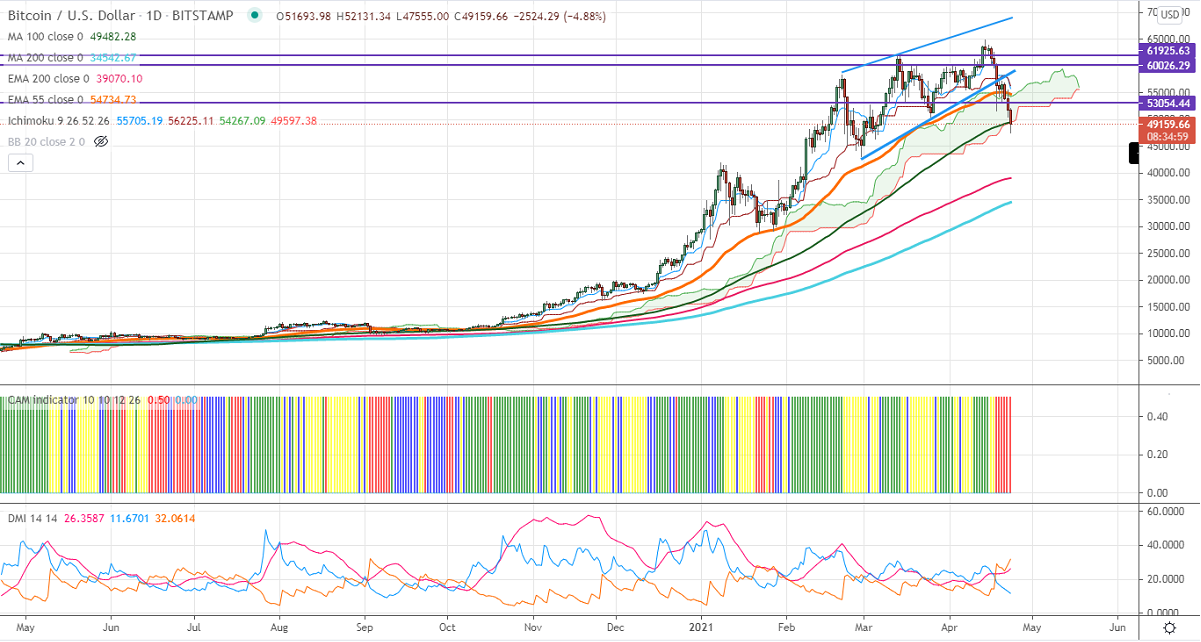

Ichimoku analysis (Daily chart)

Tenken-Sen- $57672

Kijun-Sen- $57672

BTCUSD has shown massive sell-off and lost more than 15% in the past three days. Bitcoin breaks major psychological level $50000 and holding below that level. It has lost more than $9000 this week, the biggest weekly drop since Feb 2021. The pair is trading below 100- day MA at $49364. This confirms major weakness, a dip till $43000 likely. It hits an intraday low of $47555 and is currently trading around $49094.

The near-term resistance is around $53000 (Support turned into resistance). Any indicative break above targets $54300/$5500/$56000. Major trend continuation above $65000.

The pair's minor support is around $46000.A break below will drag the pair down till $43000 (Feb 28th, 2021) is possible. Significant bearishness only if it breaks $43000.

Indicator (Daily chart)

CAM indicator –Bearish

Directional movement index – Bearish

It is good to sell on rallies around $53000 with SL around $55000 for TP of $43000.