FxWirePro- BTCUSD Daily Outlook

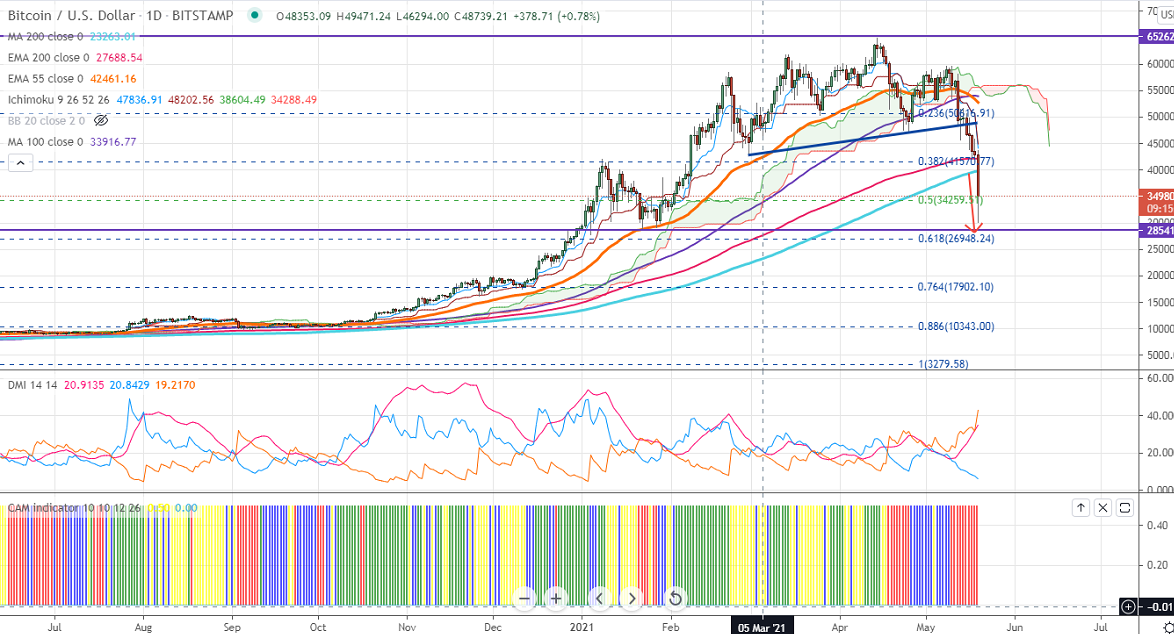

Ichimoku analysis (Daily chart)

Tenken-Sen- $50813

Kijun-Sen- $50813

BTCUSD continues to trade lower and has shown massive sell-off after China bans cryptocurrency payments. The pair has broken significant support at $39691 (200- day MA). This confirms bearish trend continuation, a dip till $28800 is possible. The intraday trend is still on the lower side as long as resistance $40700 holds. It was one of the worst performers in the past two weeks and lost more than 45%. It hits an intraday low of $30006 and is currently trading around $36650.

The near-term resistance is around $39400. Any indicative break above targets $40700/$42168/$43000. Major trend continuation above $65000.

The pair's minor support is around $30000. Any convincing break below will drag the pair down to $28392/$26948 (61.8% fib). Any close below $26900 will drag the pair down to $20000.

Indicator (Daily chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $39000 with SL around $41000 for TP of $28500.