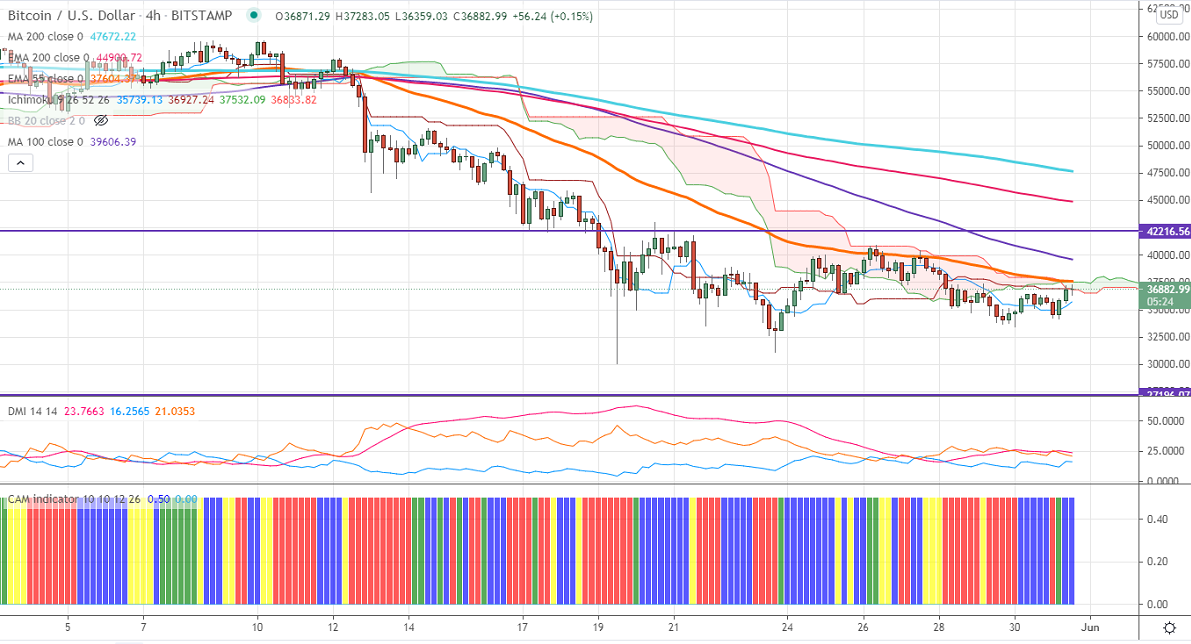

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $35739

Kijun-Sen- $36927

BTCUSD is consolidating in a narrow range between $40904 and $33425 for the past four days. The pair is still in bearish hands as long as resistance $43000. The pair has formed double bottom around $30000 and major sell-off only if it breaks $3000. Bitcoin was one of the worst performers in the past two months and lost more than 50% due to the crypto ban in China. It hits an intraday high of $37283 and is currently trading around $37018.

The near-term resistance is around $41000. Any indicative break above targets $43000/$44780/$47000. Short-term trend continuation above $47000.

The pair's minor support is around $33600. Any convincing break below will drag the pair down to $30000/$28392/$26948 (61.8% fib). Any close below $26900 will drag the pair down to $20000.

Indicator (4-Hour chart)

CAM indicator – Slightly bullish

Directional movement index – Neutral

It is good to sell on rallies around $39800-$40000 with SL around $43000 for TP of $28500.