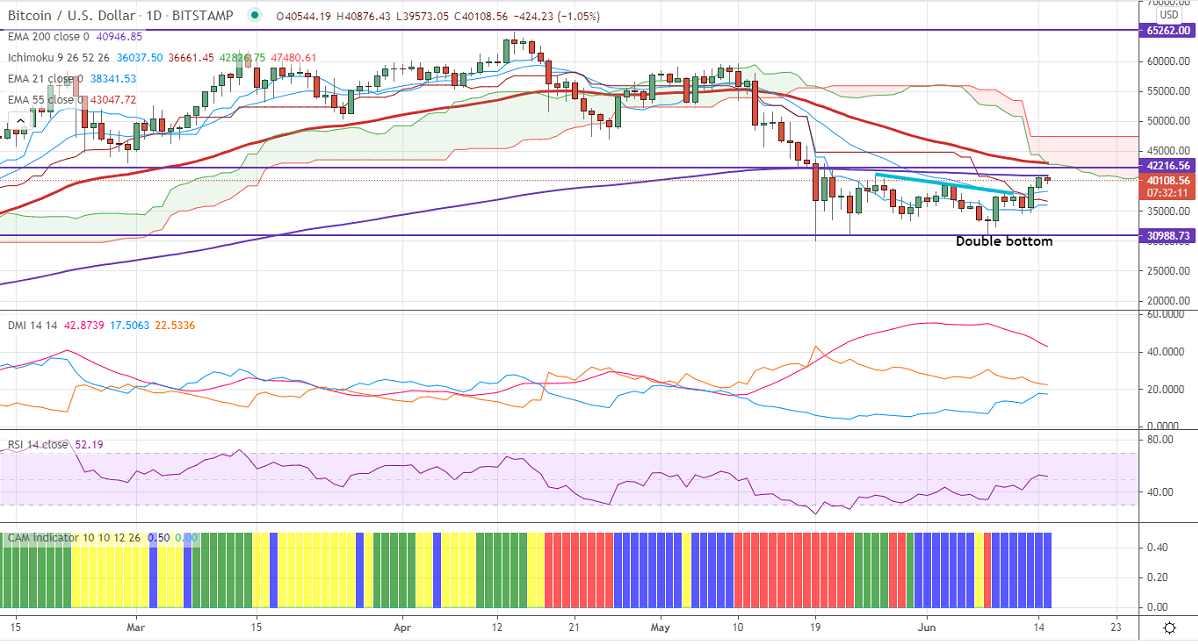

Ichimoku analysis (Daily chart)

Tenken-Sen- $36037

Kijun-Sen- $37012

BTCUSD is holding above $40000 after Elon Musk tweet increased positive sentiment. The pair hit a high of $41050 yesterday and consolidating after a minor pullback. Bitcoin has lost more than 50% from an all-time high of $64985 due to negative news from China on crypto mining. It hits an intraday low of $39573 and is currently trading around $40239.

The near-term resistance is around $42500 (200- day MA). Any indicative break above targets $43339/$45870/$47000. Short-term trend continuation above $47000.

The pair's minor support is around $37300. Any convincing break below will drag the pair down to $36540/$34800/$30000. Any close below $30000 will drag the pair down to $26800/$20000.

Indicator (4-Hour chart)

CAM Indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around $39000 with SL around $37000 for TP of $47000.