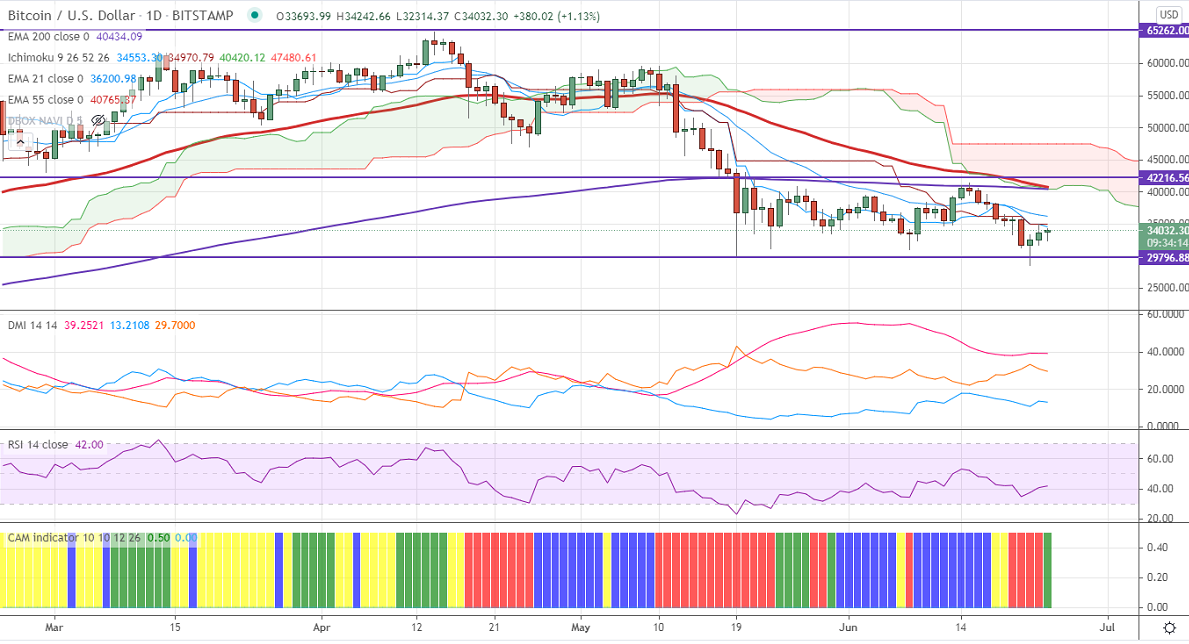

Ichimoku analysis (Daily chart)

Tenken-Sen- $34970

Kijun-Sen- $34970

BTCUSD is consolidating after a minor pullback to the $35000 level. The pair was one of the worst performers for the past six weeks and lost more than 50% on Chinese steps against crypto mining. It has formed a temporary bottom around 28600 and shown a minor recovery. The short-term trend is still bearish as long as resistance $43000 holds. It hits an intraday low of $34242 and is currently trading around $33850.

The near-term resistance is around $35000. Any indicative break above targets $38097.Minor bullish continuation above $41500.

The pair's minor support is around $32000. Any convincing break below will drag the pair down to $30000/$28500/$26800/$24651 (161.8% fib)/$22450.

Indicator (Daily chart)

CAM Indicator – Bearish

Directional movement index – Bearish

It is good to buy on dips around $28500 with SL around $25000 for TP of $41300.