BTCUSD trades flat ahead of US GDP data.It t hit a low of $67096 yesterday and is currently trading around $67638.

BlackRock’s ishares Bitcoin trust reached $20 billion in less than 137 days. A s of May 22 , whale accumulation rose by 5.5% compared to 4.2% by May 1st.

US markets -

NASDAQ (negative correlation with BTC) - Bullish (neutral for BTC). The NASDAQ trades flat ahead of US economic data. Any close above 19000 will take the index to 19200/19500.

Major economic data for the day -

US GDP and Initial jobless claims (12:30 pm GMT)

According to the CME Fed watch tool, the probability of a no-rate cut in June decreased to 98.20% from 98.50% a week ago.

Technicals-

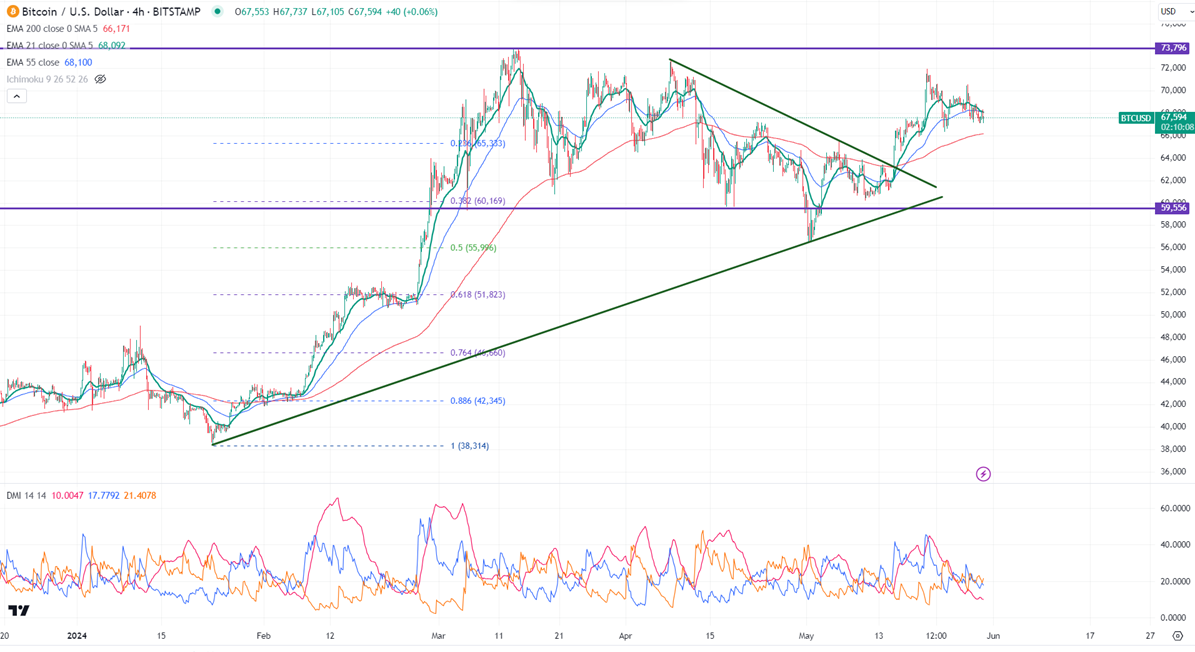

BTCUSD trades above the short-term moving average (21 and 55 EMA) and the long-term moving average (200 EMA) in the 4-hour chart.

Minor support- $65000. Any break below will take it to the next level at $63000/$60000/$56000/$50000.

Bull case-

Primary supply zone -$75000. Any break above confirms a bullish continuation. A jump to $80000 is possible.

Secondary barrier- $80000. A close above that barrier targets $100000.

It is good to buy on dips around $65000 with SL around $63000 for TP of $75000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary