- NZD/JPY has retraced brief dip below major support levels at 100 and 200 DMAs.

- Price retraced from lows of 78.81 and is currently hovering around 200-DMA at 79.75.

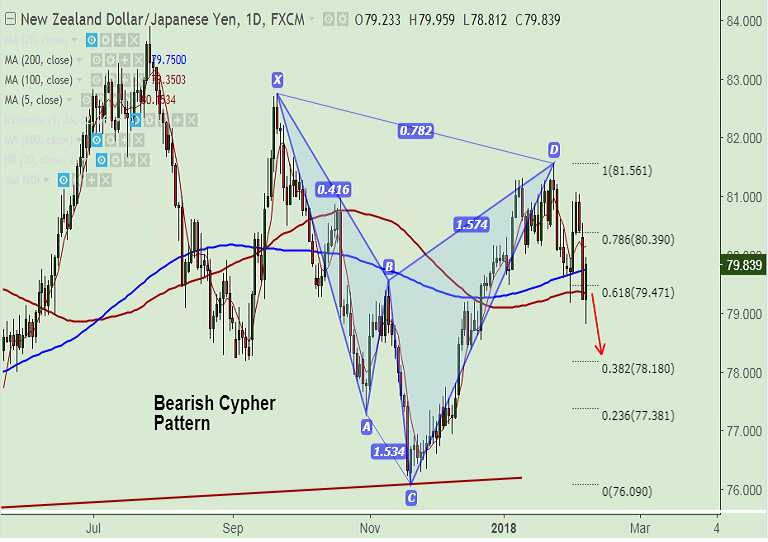

- 'Bearish Cypher' pattern has been completed on daily charts which keeps scope for downside.

- Focus on the upcoming NZ employment details and the key RBNZ monetary policy meeting on Wednesday and Thursday respectively.

- Technical indicators are bearish. Decisive break below 100-DMA could see test of 61.8% Fib at 78.18.

- On the flipside, close above 200-DMA could see test of 20-DMA at 80.37. Bearish invalidation likely on breakout at 20-DMA.

Support levels - 79.47 (38.2% Fib), 79.34 (100-DMA), 78.18 (61.8% Fib retrace of 76.090 to 81.561 rally)

Resistance levels - 80.11 (5-DMA), 80.27 (23.6% Fib), 81

Recommendation: Good to stay short on close below 100-DMA, SL: 79.75, TP: 78.20/ 78/ 77.30

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest