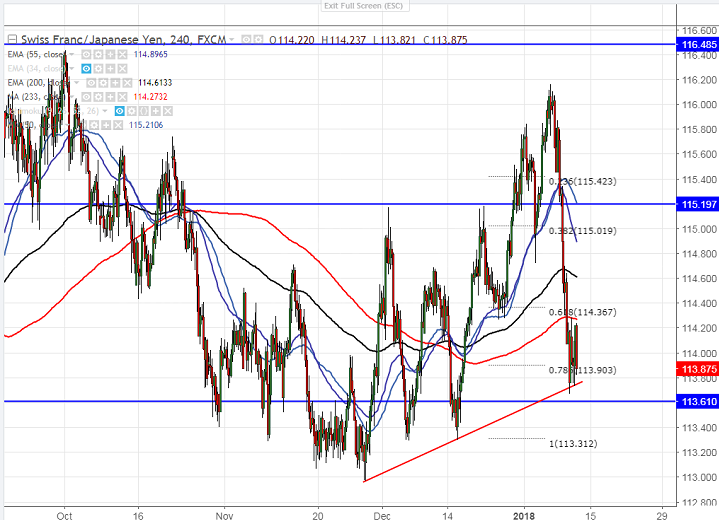

- Major support – 113.72 (trend line joining 113.09 and 113.29).

- CHF/JPY is consolidating in narrow range after hitting low of 113.66 yesterday. The pair has shown a minor jump of 60 pips from the low till 114.28. It is currently trading around 114.06.

- Any daily close below 113.70 (trend line support) confirms further weakness, a decline till 113.29 (Dec 15th 2017 low)/112.96 likely.

- On the higher side, near term resistance is around 114.28 (233- day MA) and any break above will take the pair to next level till 114.56 (55- day EMA)/115/115.21. Short term bullish continuation only above 116.50.

It is good to buy on dips around 113.75 with SL around 113.30 for the TP of 114.55/115.