The EUR/JPY lost its shine on the weak Euro. It hit a low of 162.10 and is currently trading around 162.42.

Intraday bias remains bearish as long as resistance 163.89 holds. The pair remained within a narrow range of 163.61 and 162 for the past week.

Markets eye ECB Lagarde speech for further direction.

Technicals-

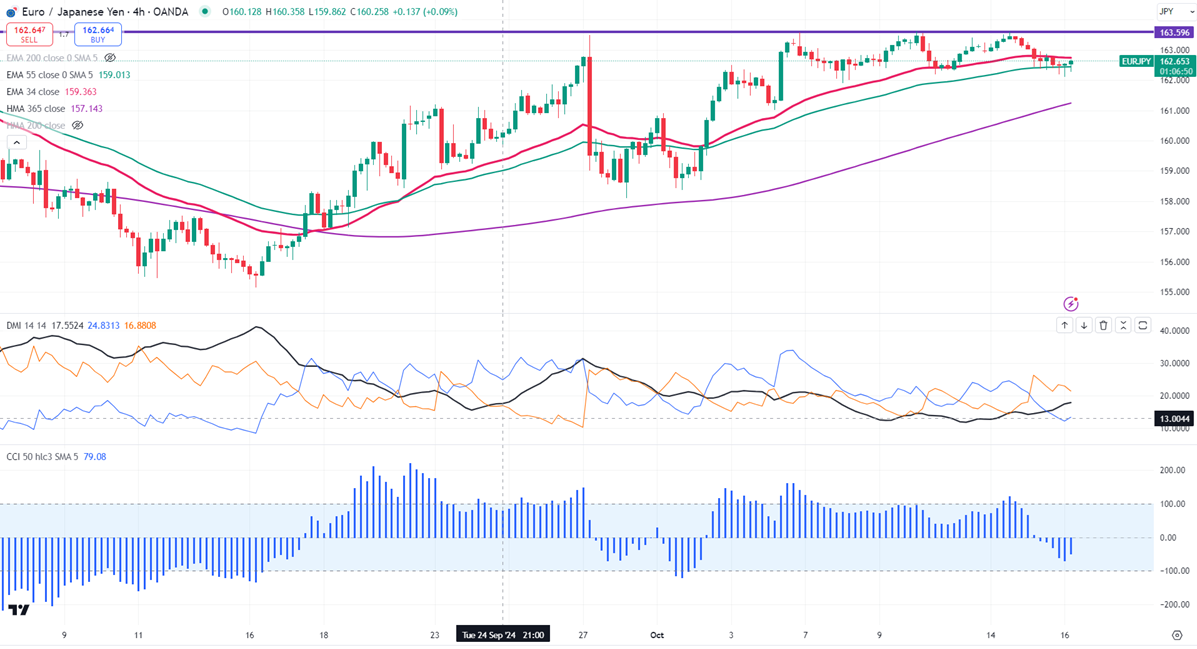

The pair is trading below 34- and above 55 EMA and 365 hull moving average in the 4-hour chart.

The near-term resistance is around 162.75, a breach above targets 163/163.60/163.89/164.64/165/167.37 (61.8% fib retracement level from 175.41 and 154.40) The immediate support is at 161.90, any violation below will drag the pair to 161.20/160.65/160/159/158.35.

Indicator (4-hour chart)

CCI (50)- Bearish

Average directional movement Index - Bearish. All indicators confirm a mixed trend.

It is good to buy above 163.60 with SL around 163 for a TP of 165.