FxWirePro Currency Strength Index for CAD/CHF: Bias Bearish

FxWirePro's Hourly CAD Spot Index was at -105.293 (Bearish)

FxWirePro's Hourly CHF Spot Index was at 126.714 (Bullish)

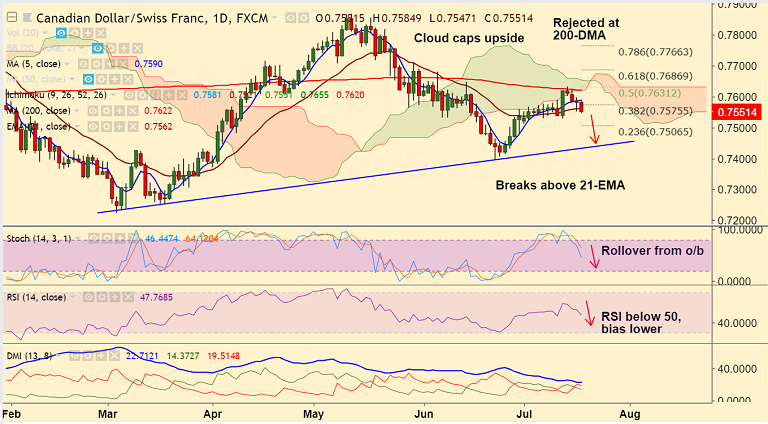

Technical Analysis: Bias Bearish

- Rejected at 200-DMA, extends weakness for 4th straight session

- Cloud caps upside, breaks below 5-DMA and 21-EMA

- Stochs show rollover from overbought levels

- RSI has fallen below 50, bias lower

Support levels - 0.7530 (July 12 low), 0.75, 0.7435 (trendline)

Resistance levels - 0.7562 (21-EMA), 0.7590 (5-DMA), 0.7622 (200-DMA)

Recommendation: Good to go short around 0.7560/70, SL: 0.7625, TP: 0.7530/ 0.75/ 0.7440

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: CAD/CHF Trade Idea

Wednesday, July 18, 2018 10:48 AM UTC

Editor's Picks

- Market Data

Most Popular