Ichimoku Analysis (hourly chart)

Tenken-Sen- 81.79

Kijun-Sen- 81.62

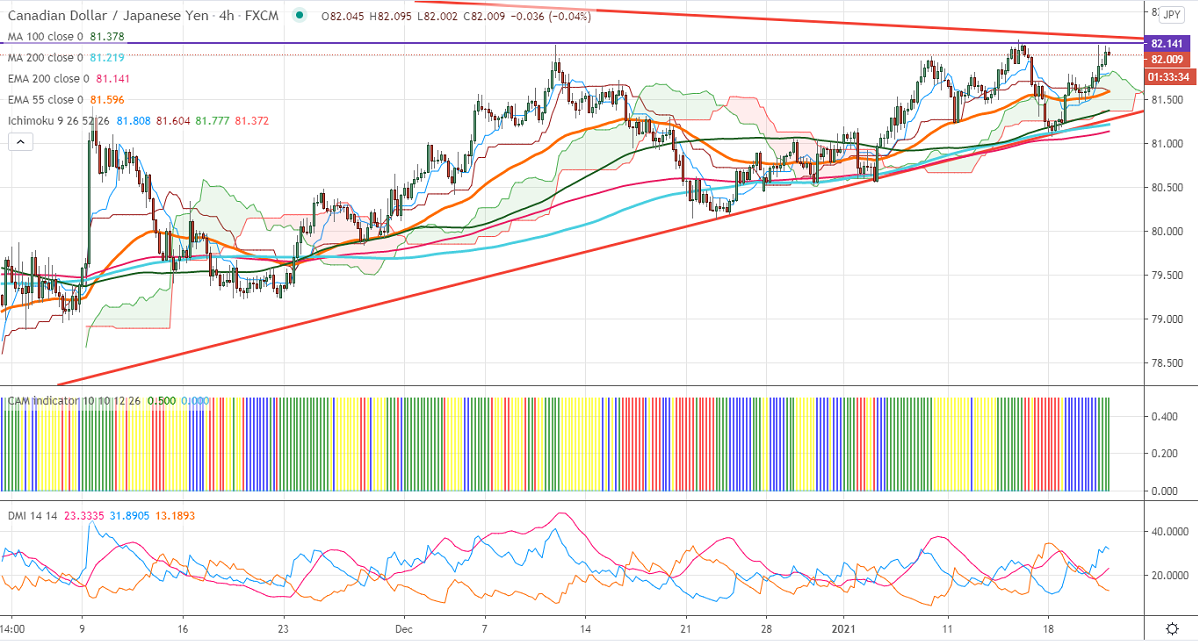

CADJPY is trading higher for 2nd consecutive days on a strong Canadian dollar. It has kept its rates unchanged and promised to keep on hold until the inflation target reaches. Canadian CPI slows down to -0.2% compared to a forecast of 0.1%. USDCAD hits a 33-month low after BOC monetary policy. Short term trend of CADJPY is bullish as long as support 81 holds.

On the lower side, near term support is around 81 and any violation below will take the pair till 80.55/79.69/79.25/78.82.

The significant resistance is at 82.20, any indicative break above that level targets82.68/83. Significant trend reversal only above 83.15.

It is good to buy on dips around 81.20 with SL around 80.60 for the TP of 83.