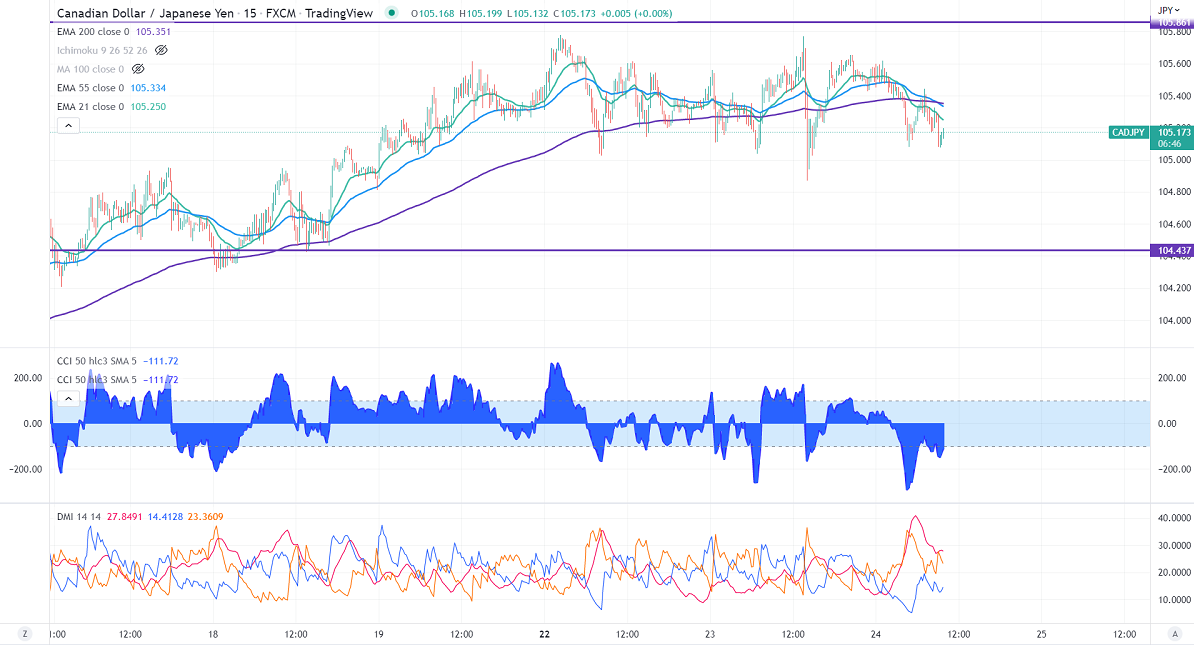

CADJPY formed a double top around 105.80 and showed a minor decline on the strong yen. The minor pullback in WTI Crude oil prices supports the pair at lower levels. Technically in the 15 min chart, the pair is holding below short term (21- and 55 EMA) and

200 EMA (105.35). Any break above 105.35 will take the pair to 105.80/106.50. CADJPY hits an intraday high of 105.08 and is currently trading around 105.12.

The near-term support is around 104.80, any breach below targets 104/103.35/102.90.

Indicators (15-Min chart)

CCI (50)- Bearish

ADX- Bearish

It is good to sell on rallies around 105.35-40 with SL around 105.85 for TP of 104.