CAD/JPY lost its shine on the weak Canadian dollar. It hit a low of 104.53 and is currently trading around 104.92.

Tariffs placed by the Trump administration on Canadian imports scheduled to be instituted on February 4, 2025, will now go into effect on March 4, 2025. Tariffs consist of a 25% tariff for most Canadian imports, along with a reduced tariff of 10% solely applied to Canadian energy exports. Tariff implementation delay was intended to provide Canada time to enhance its border security as well as deal with fentanyl and immigration issues. In response to U.S. tariffs, Canada has queued up retaliatory tariffs against U.S. goods valued at approximately $155 billion, to be applied in case the U.S. actions are implemented. The U.S. justification for imposing such tariffs is based on border security matters and the fentanyl importation into the country

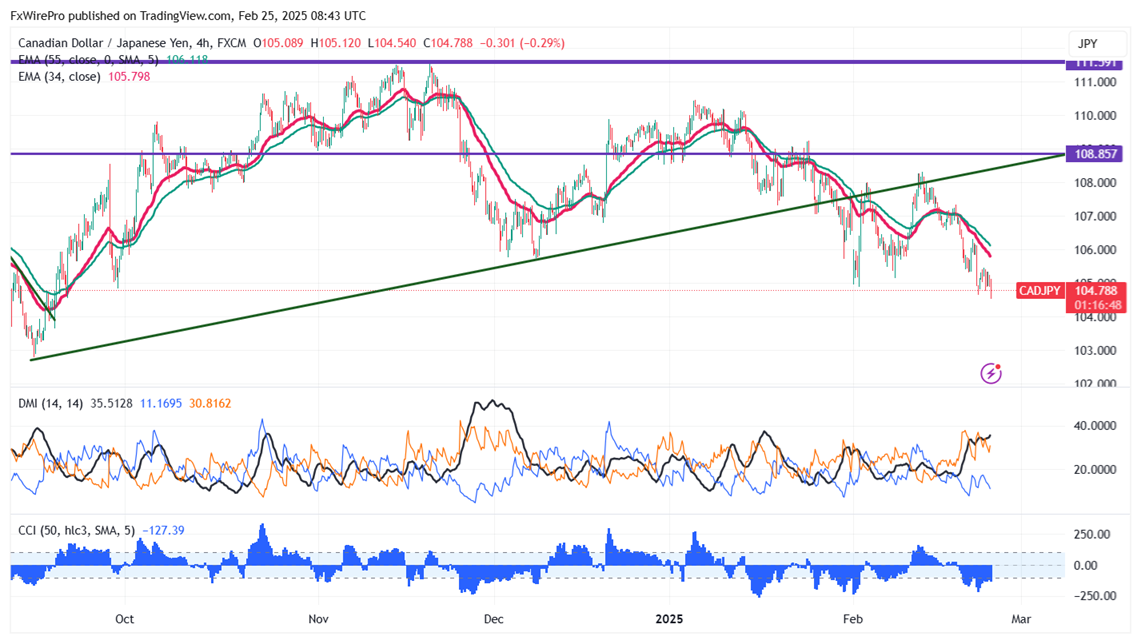

Technical Analysis

CAD/JPY is currently trading below the 34- and 55-EMA on the 4-hour chart. The immediate resistance is at 105.50; a breach above this level could shift targets to 106/106.55/107/107.40/108/108.35/109.30/110. On the lower side, near-term support is at 104.50, and a break below this support could lead to declines toward 104/103.49/102.80.

Indicator Trends

CCI (50)- Bearish

ADX (14)- Neutral

Trading Strategy Recommendation

It is good to sell on rallies around 105.58-60 with a stop-loss set around 106.65 and a target price of 102.80.