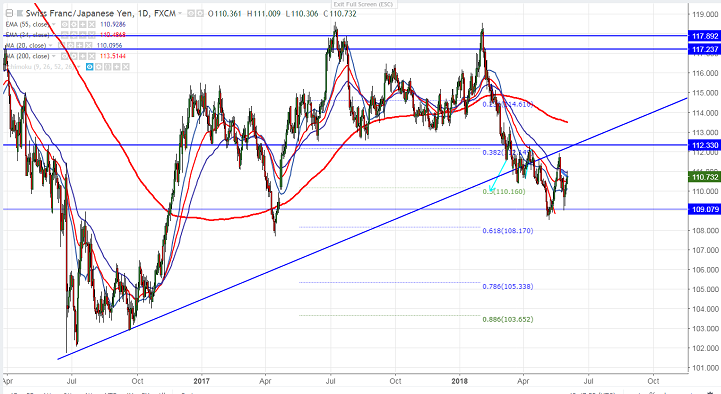

- Major Intraday resistance- 110.75.

- CHF/JPY has broken major intraday resistance at 110.75 and jumped till 111 at the time of writing. The pair has recovered almost 200 pips from the low of 109.It has declined almost 800 pips from temporary top of 118.55 made on Feb 2nd 2018 and is currently trading around 110.77.

- The pair declined till 110.66 for the day after hitting high of 111. Any major weakness can be seen if pair trades well below 108.50-109. Any break below 108.50 targets 107.85/107.

- The minor bullishness can be seen only above 111 and any break above will take the pair till 112/112.28/113.48. Any break above 113.50 confirms further bullish continuation.

It is good to buy on dips around 110.55-60 with SL around 110 for the TP of 112/112.30.