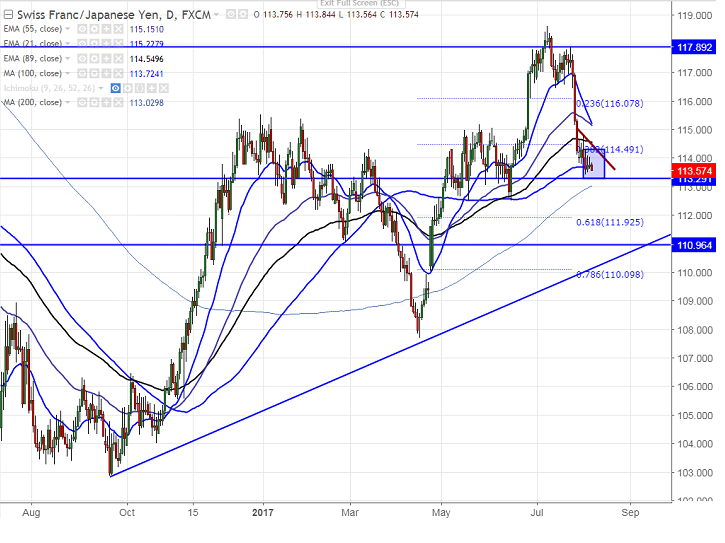

- CHF/JPY has formed a major bottom around 113.41 and shown a minor recovery till 114.08 yesterday. It is currently trading around 113.55.

- The pair upside capped by 7- day MA at 113.95 and any confirm break above will take the pair till 114.73 (10- day MA)/115. Any convincing break above 115 will take the pair till 115.40 (21- day EMA)/116.

- On the lower side, near term support is around 113.40 (Aug 3rd 2017 low) and any break below will drag the pair till 112.99 (200- day MA)/ 112.50 (Jun 14th 2017 low)/111.92 (61.8% retracement of 107.84 and 118.60).

It is good to sell on rallies around 114.-114.10 with SL around 114.50 for the TP of 113.40/113/112.50.

Resistance

R1- 113.95

R2 -114.73

R3- 115

Support

S1-113.40

S2-113

S3-112.50